GRI reference: 2-12, 3-1

In 2022, CLP undertook the Year 2 assessment approach.

Conduct desktop research and stakeholder interviews

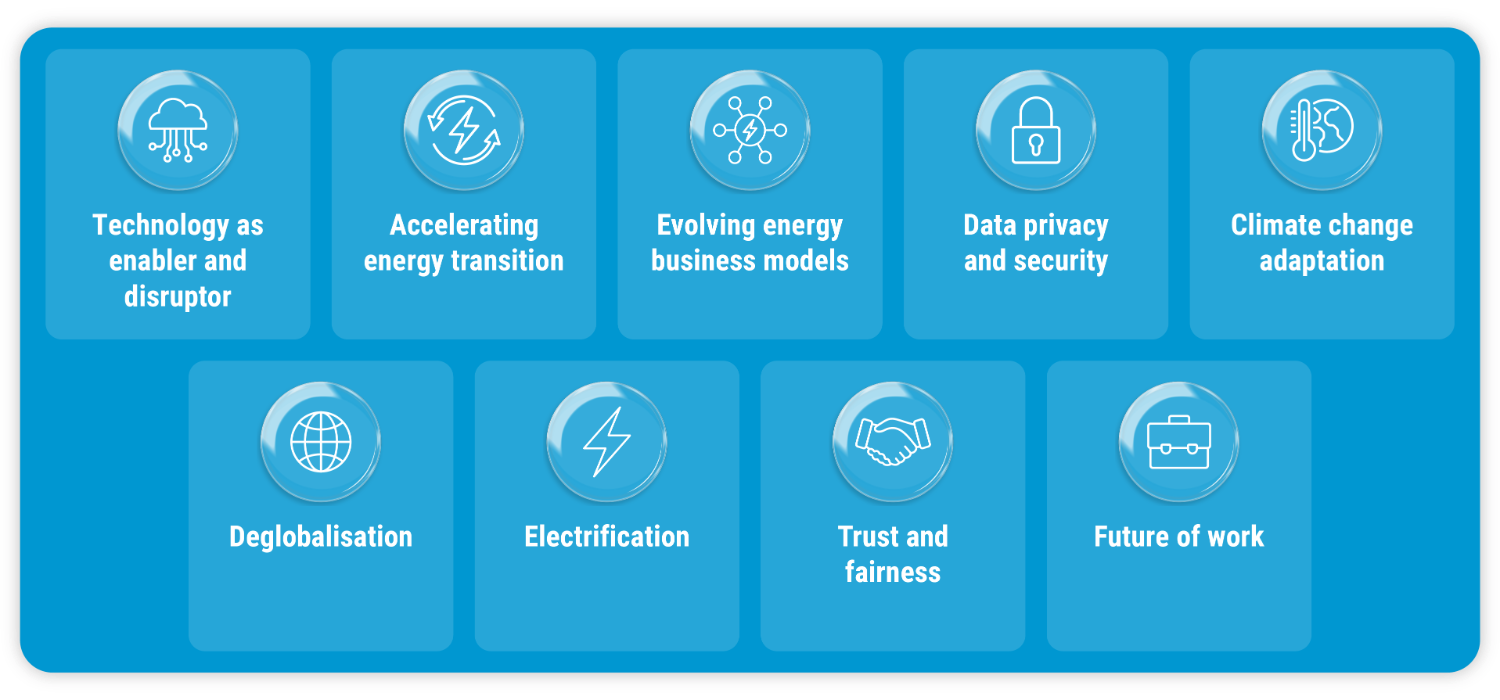

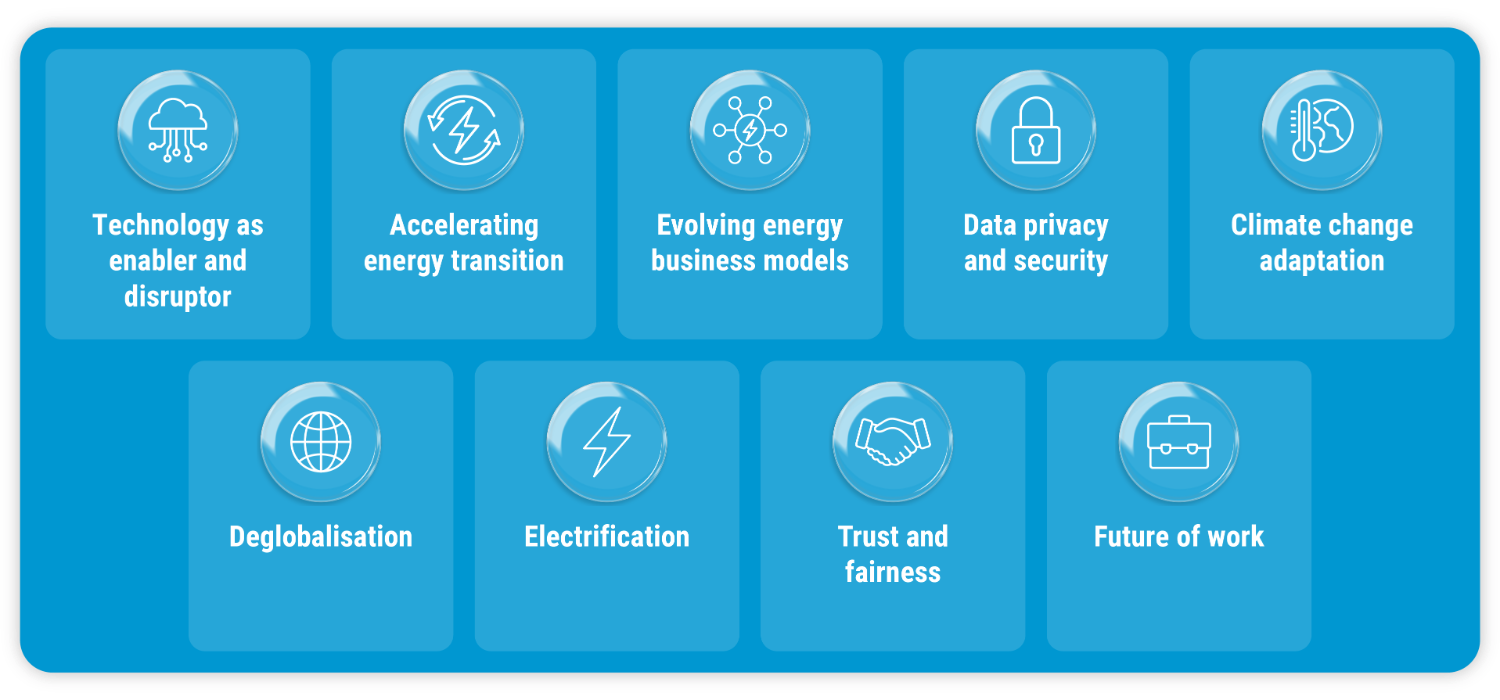

Megatrends are large, transformative global forces that define the future by having a far-reaching impact on business, economies, industries, societies and individuals. In 2022, CLP conducted a review of prior megatrend analysis and validated that the nine megatrends identified in 2021 remain relevant to CLP and reflect CLP’s underlying strategic objectives.

Interviewing stakeholders is a key step in any materiality process. CLP’s senior management from a wide range of disciplines was interviewed in 2021 (Year 1). In 2022, in line with the Year 2 assessment process, external materiality experts were interviewed to gauge their views on evolving best practice and how this aligns with CLP’s current approach to reporting.

In addition, CLP conducted megatrends analysis and reviewed its risk registers, internal strategy papers and company policies, and GRI and Sustainability Accounting Standards Board (SASB) guidance, to help identify impacts, risk and opportunities conceivably material to CLP’s current and future prospects. The process undertaken is evidence-based.

The megatrends impacting CLP

Identify impacts, risks and opportunities

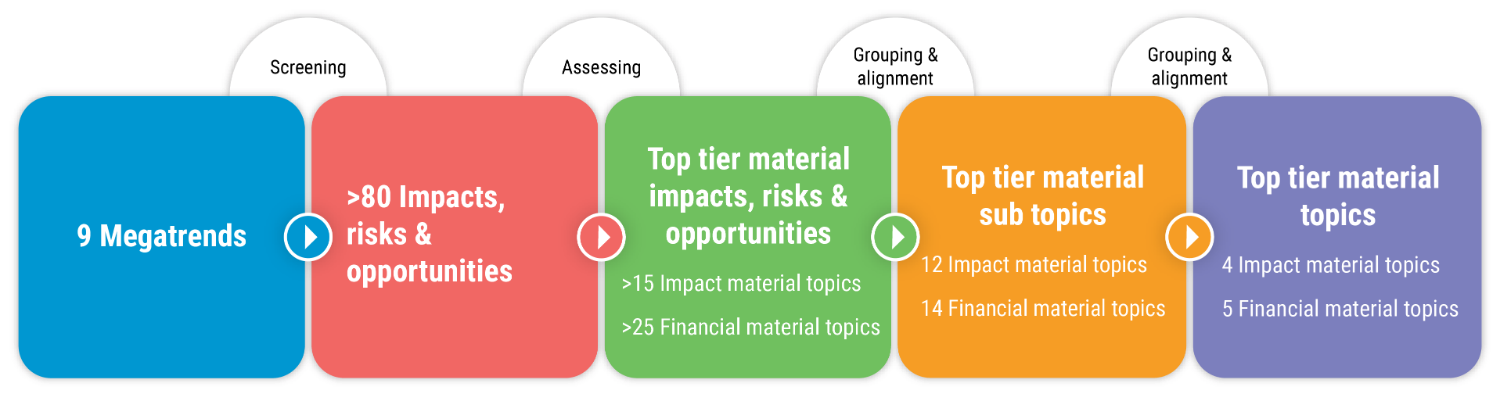

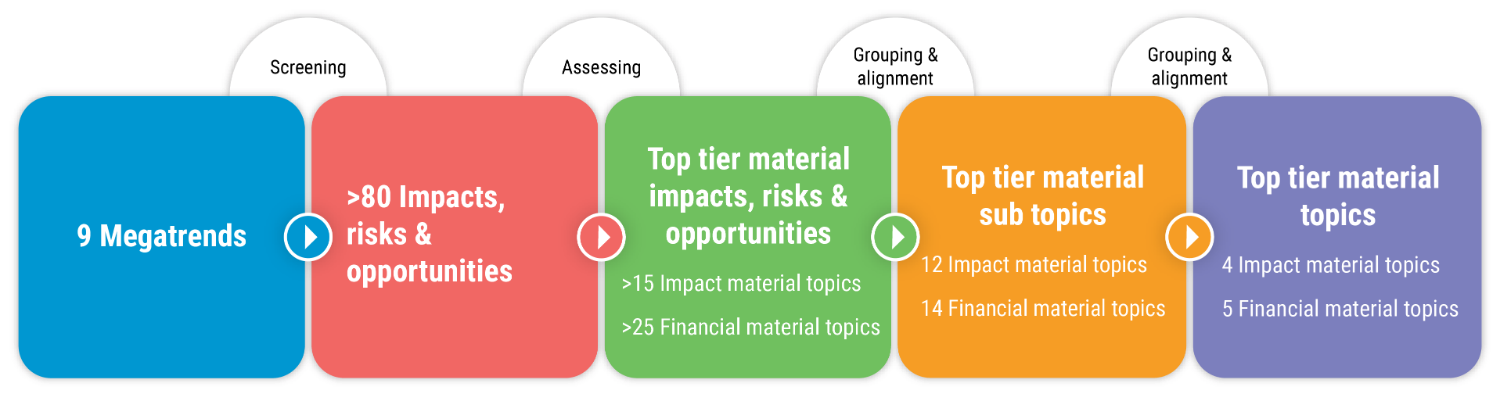

Applying the assessment process, in 2022 (Year 2) CLP identified over 80 potential stakeholder impacts and financial risks and opportunities.

‘Impact materiality’ refers to significant positive or negative impacts on people, the economy and the environment, including impacts on human rights, as per the GRI definition.

To integrate data-driven evidence as part of the materiality assessment process, in 2022 CLP introduced an artificial intelligence (AI)-driven tool to identify evidence of ESG risks and opportunities from relevant sources such as corporate reports, regulations, standards, news and social media.

‘Financial materiality’ refers to financial risks or opportunities which create, preserve or erode enterprise value, as per the International Sustainability Standards Board (ISSB) Exposure Drafts. These risks and opportunities are considered to have implications for the organisation’s revenues, expenses or balance sheet, which in turn means either a negative or positive and actual or potential impact on CLP’s stakeholders or enterprise value.

Assess and validate impacts, risks and opportunities

In 2022, CLP enhanced the assessment methodology by considering the severity and likelihood for risk, and the benefit and likelihood for opportunities.

Each impact, risk and opportunity was assessed as either negative or positive, actual or potential (as per the latest GRI 3: Material Topics 2021 guidance).

In terms of ‘impact materiality’, over 15 risks and opportunities were judged as ‘high’ or ‘transformational’; none were classified as ‘extreme’. These were then arranged under broader sub-topics, and ultimately top-tier material topics. This alignment exercise resulted in a slightly revised number of top tier sub-topics (12) and top tier material topics (4) in 2022.

To finalise the assessment phase, the significance of each negative impact or financial risk was evaluated for its severity and likelihood. The methodology employed drew from the latest GRI guidance, ISO 31000 Risk Management Standard, and CLP’s Group Risk Management Framework.

A similar methodology was devised to assess the significance of each positive impact and financial opportunity, with each evaluated for its benefit and likelihood.

It must be noted that the methodology CLP employs to assess for sustainability-related materiality aligns with and supports CLP’s general approach to risk management.

The preliminary results of the Year 2 assessment were presented to CLP’s Sustainability Executive Committee and the Board-level Sustainability Committee. Both committees validated the findings identified by the working group.