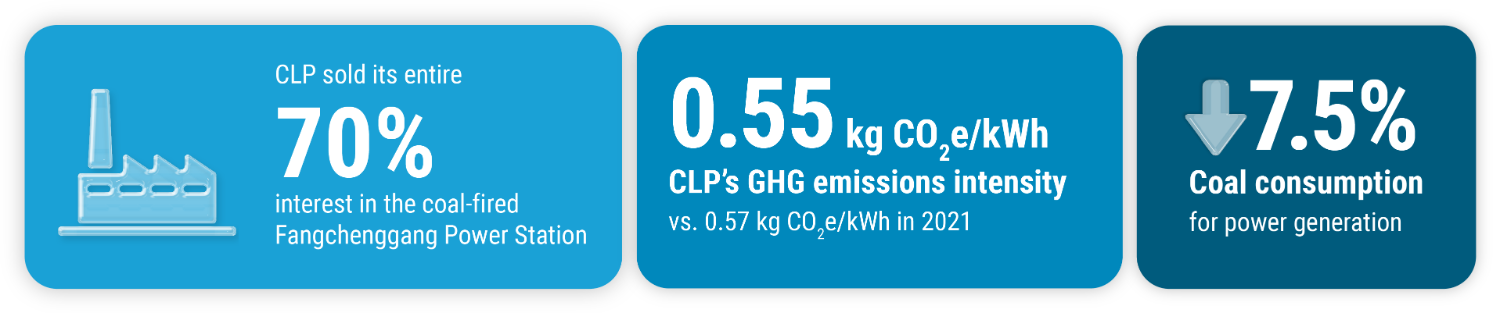

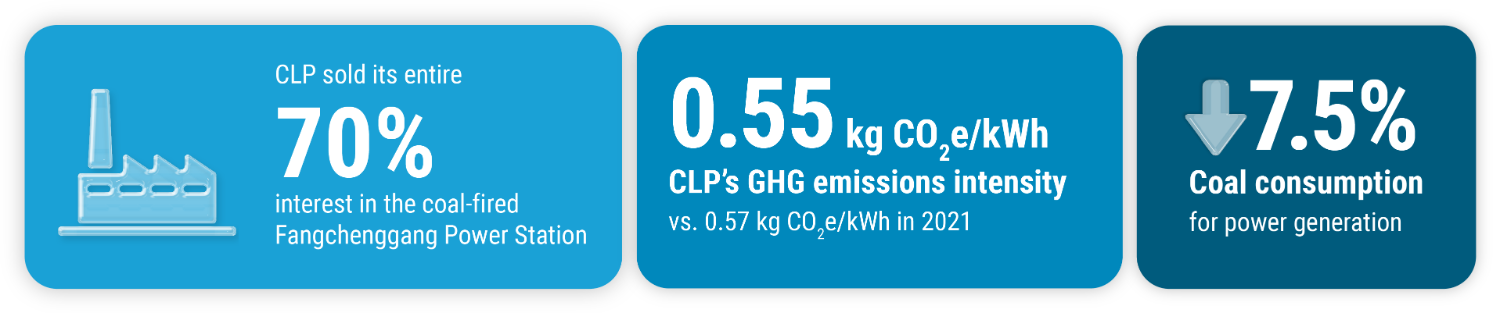

As per CLP’s Climate Vision 2050, efforts to identify opportunities to phase out coal-fired power generation continue. In November 2022, CLP sold its entire 70% interest in the coal-fired Fanchanggang Power Station in Mainland China.

CLP carefully reviewed all possible exit strategies for this plant and considered divestment the most appropriate option. Handing ownership to a trusted partner, in CLP’s view, supports a just transition that aligns with the Group’s Value Framework and Labour Standards. In addition, CLP considers that transferring the Group’s interest in the plant to a state-owned enterprise supports continued power supply reliability in the community as well as an efficient and orderly transition in line with China’s decarbonisation policy. At the same time, the sale freed up capital to grow CLP’s renewable portfolio in Mainland China.

The sale of this coal-fired plant accelerates CLP’s decarbonisation trajectory and is expected to reduce the Group’s absolute annual greenhouse gas (GHG) emissions by around 10% compared with 2022 levels on an equity plus long-term capacity and energy purchase basis. This demonstrates CLP’s strong commitment to accelerate phasing out coal-based assets and achieve the net-zero GHG target by 2050.

In 2022, CLP Group reduced the GHG emission intensity of electricity sold to 0.55 kg CO2e/kWh when compared to 0.57 kg CO2e/kWh in 2021, while the GHG emission intensity of electricity sold in Hong Kong by CLP Power maintained at

0.39 kg CO2e/kWh.

CLP maintains its commitment to progressively phase out coal-fired generation plants.

In Hong Kong, older coal-fired generation units at Castle Peak A Power Station will be retired in the next few years, while daily coal-fired power generation at Castle Peak B Power Station will be ceased by 2035. The phase-out of CLP's minority-owned coal-fired assets in Mainland China and Taiwan is also expected before 2030.

In Australia, the closure of Yallourn Power Station will reduce EnergyAustralia’s Scope 1 carbon emissions by over 60% in 2028-2029 against the 2019-2020 base year.

The other remaining coal-fired power stations where CLP maintains operational control are Jhajjar Power Station (operated by Apraava Energy) and Mount Piper Power Station (owned by EnergyAustralia). CLP maintains its commitment to find practical solutions to phase out these coal-fired power generation assets from its portfolio in the mid- to late 2030s and by 2040 at the latest, respectively.

As the climate crisis brings a raft of pressing problems to all regions of the world, CLP remains a trusted partner in transitioning its assets to a clean energy portfolio. This steady progression to low-carbon electricity infrastructure ensures CLP’s customers continue to have options for accessing clean energy supply.

Over the years, CLP maintained its dialogue with governments and communities through various channels to help shape and deliver their long-term decarbonisation and environmental objectives.

For instance, CLP Power Hong Kong Limited (CLP Power) organised various working and advisory committees, panels and meetings to actively listen to community voices. The Company organised site visits to Black Point Power Station for more than 20 members of the Hong Kong Legislative Council and around 40 senior government officers in October and December 2022 respectively. The visits aimed to strengthen communications and enhance understanding of CLP Power’s multi-pronged approach to decarbonisation in support of the Hong Kong Government’s target to achieve carbon neutrality by 2050.