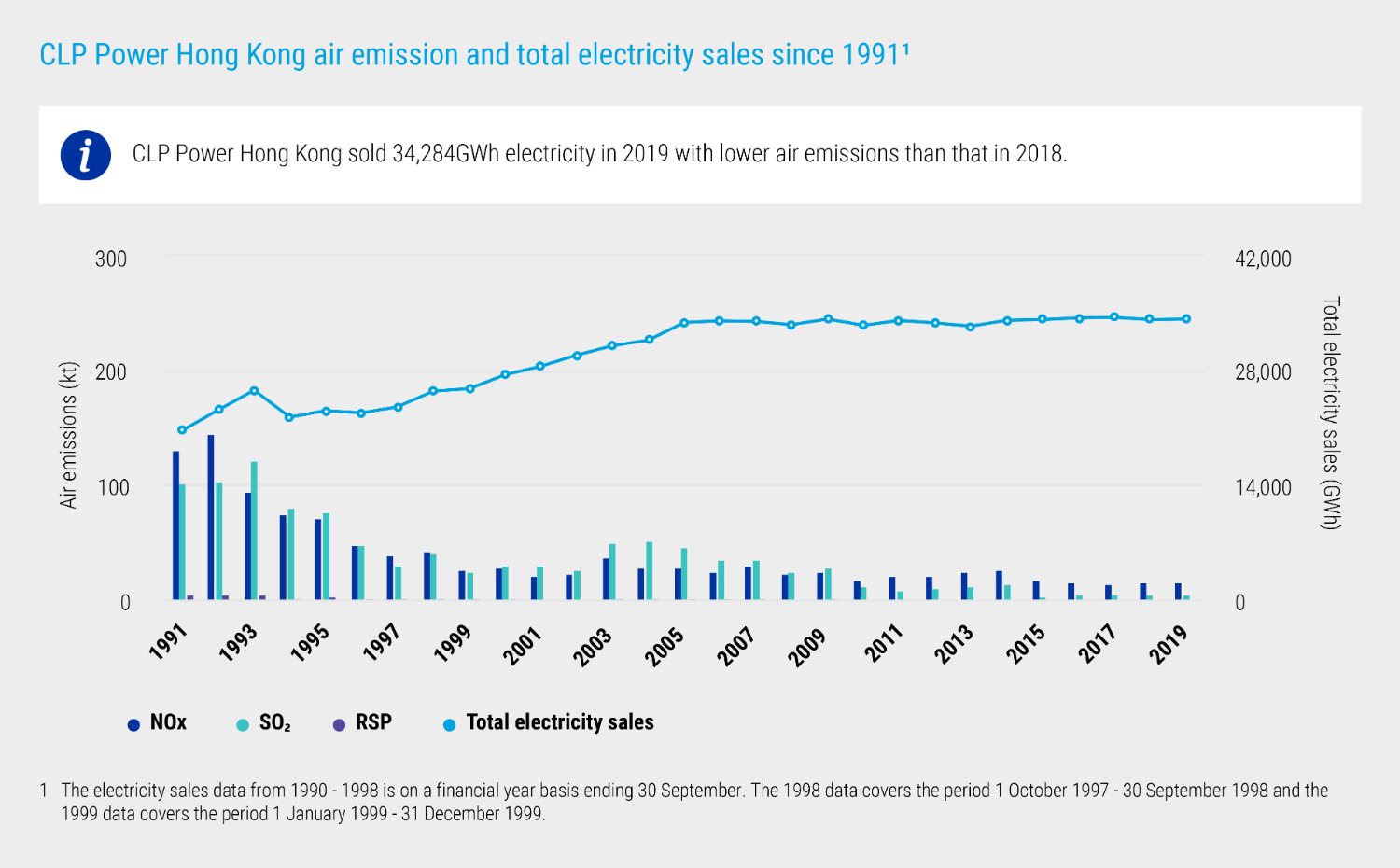

All Hong Kong assets under CLP’s operational control maintained full compliance with environmental regulations in 2019.

CLP Power has concluded discussions with the Hong Kong Government on the new emissions cap starting in 2024. Under the Technical Memorandum, the allowances for air emissions of sulphur dioxide (SO2), nitrogen oxides (NOx) and respirable suspended particulates (RSP) will be reduced by 90%, 66% and 65% respectively compared to 2010 levels. The upgrade of all existing combined cycle gas turbine (CCGT) units and the development of two new additional CCGT units will ensure CLP is ready. CLP is also cognisant of the Government’s plan to tighten the Air Quality Objectives for which a public consultation was conducted in 2019.

Standard ESG Disclosures

Go to

About sustainability reporting

CLP continually improves by managing, monitoring and reporting its performance. These tables present a quantitative overview of the Group's 2019 financial and non-financial performance. The disclosures are selected from the GRI Standards, Hong Kong Stock Exchange ESG Reporting Guide and TCFD Electric Utilities Preparer Forum, as well as other key performance data.

2019 data shaded in orange have been independently verified by PricewaterhouseCoopers. The assurance scope of past years' data can be found in previous Sustainability Reports.

Corporate governance framework and code

Good corporate governance promotes and safeguards the interests of shareholders and other stakeholders. CLP is committed to maintaining a rigorous framework of corporate governance which upholds the Group’s credibility and reputation.

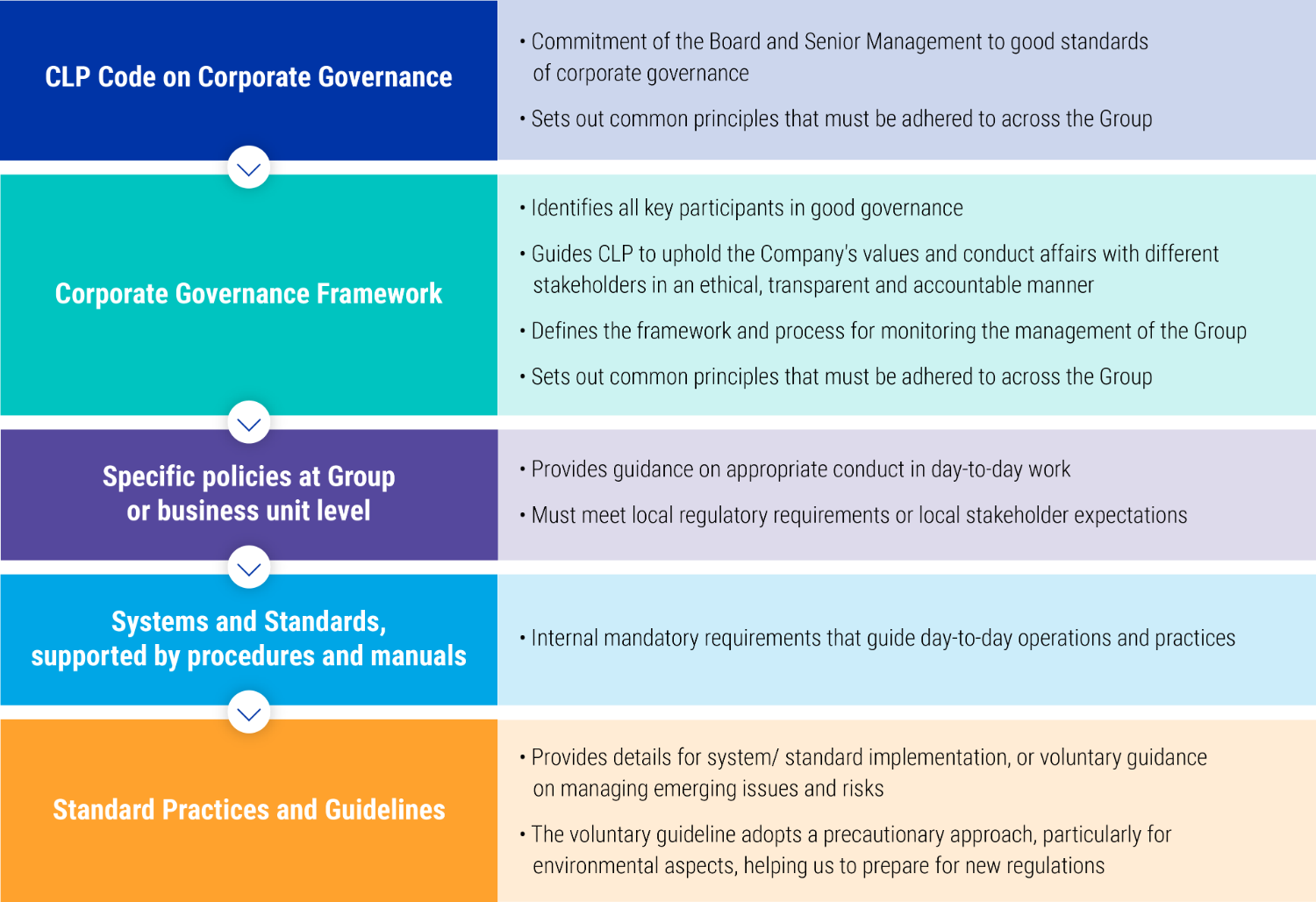

Corporate governance is a matter of culture, driving CLP to continually make conscious decisions around correct behaviours. The table summarises how CLP manages corporate governance through the CLP Code, the CLP Corporate Governance Framework and a comprehensive set of policies and guidelines:

How CLP Holdings approaches corporate governance

The CLP Code was updated in 2019 to reflect new requirements under the Rules Governing the Listing of Securities issued by The Stock Exchange of Hong Kong Limited and CLP's current corporate governance practices. While embracing the terms set out within the Hong Kong Stock Exchange’s Corporate Governance Code and Corporate Governance Report, the CLP Code seeks to go beyond this by advancing a structure that builds on CLP’s own standards and experience.

The Board is CLP’s highest governance body and actively promotes the success of the Group by directing and supervising all of its affairs in a responsible and effective manner. Some of these responsibilities are discharged through delegation to six Board Committees. The two committees most involved in sustainability-related matters are the Sustainability Committee and the Audit & Risk Committee.

Download the CLP Code on Corporate Governance Find out more about sustainability governanceThe Corporate Governance Report in the Annual Report discloses CLP’s governance performance in detail. Following the enhancement of the Board Diversity Policy in early-2019, the gradual refreshment of the Board is underway and this was also extended to the membership of the Board Committees.

CLP continues to take a forward-looking approach in enhancing its corporate governance practices. Recognising a number of signature strengths of the Board, the external Board Review undertaken in 2019 has also identified opportunities to further enhance the Board’s contribution to CLP's long-term strategic agenda.

Read the Corporate Governance Report in the 2019 Annual Report

The Human Resources and Remuneration Committee Report covers CLP's Remuneration Policy, including the non-financial metrics considered for executive’s remuneration.

Code of Conduct and anti-corruption

The Code of Conduct is available to the public and applies across the entirety of CLP Group – including CLP Holdings, its wholly owned subsidiaries, and joint ventures or companies in which CLP holds a controlling interest. All employees of CLP, irrespective of their position and function, are expected to fully adhere to the principles contained in the Code. In the case of joint ventures or companies in which CLP does not hold a controlling interest, the representatives are also expected to act in accordance with the Code and to make a concerted effort to influence those with whom they are working to follow similar standards of integrity and ethical behaviour. Likewise, contractors working for CLP are encouraged to follow the Code for the duration of their contract, and also encourage their subcontractors to do the same.

Download CLP's Code of Conduct

CLP's Whistleblowing Policy encourages employees and related third parties (such as customers and suppliers) who deal with CLP to raise concerns about any real or perceived misconduct, malpractice or irregularity through a confidential reporting channel.

Training and awareness

Training in relation to the Code of Conduct is mandatory for all staff after joining the Company. CLP promotes the Code of Conduct and Whistleblowing Policy to employees on a regular basis, by advising of any updates or revisions. Every four years, the Company conducts a Business Practice Review (BPR) process for all employees in person to refresh a company-wide understanding of the principles of the Code, and help to ensure business practices remain compliant. Any potential issues are raised and reviewed with management. A number of case studies based on past violations are also included to highlight how to properly handle potential and actual situations in which the Code has been violated. Contractors are encouraged to attend the BPR sessions alongside CLP employees.

Monitoring and follow-up

The General Representation Letter (GRL) process is one of the means by which non-compliance with the Code can be reported. The process reinforces personal responsibility for good governance and sets controls at all levels within CLP. For instance, business practices are reviewed and fraud risks in different areas assessed as part of the process, while irregularities or exceptions are reported for the attention of senior management. Managers in the Group are also required to sign the Code of Conduct Compliance Statement on an annual basis.

The CLP-wide reporting system for Code of Conduct violations applies to any alleged or potential breach. All CLP employees are expected to co-operate fully in the investigation of an alleged violation, and disciplinary action applies to any staff member found to be in breach of the Code. The number of breaches of the Code and any cases of corruption are reported annually, with the relevant data verified by a third party.

Operational responsibilities

Potential violations of the Code of Conduct are reported to the Group Internal Audit (GIA) by employees, vendors, contractors and GIA auditors. Communications are received through means such as anonymous letters, emails or phone calls.

GIA regularly reviews compliance with the Code, and investigates any potential violations, except for those related to human resources, which are investigated by Human Resources (HR).

Non-compliance with the Code results in disciplinary action. The Group Code of Conduct Committee, which comprises the Executive Director and Chief Financial Officer, Group General Counsel & Chief Administrative Officer, and Chief Human Resources Officer, reviews and endorses any disciplinary measures taken.

For a quicker response to Code of Conduct violations in Australia, EnergyAustralia has been delegated the responsibility to manage and take action for violations committed by EnegyAustralia employees. EnergyAustralia will inform the CLP Holdings Audit & Risk Committee of cases involving senior EnergyAustalia employees.

For CLP India, a separate Internal Complaints Committee was established to handle complaints of sexual harassment at the workplace in accordance with Indian law.

During 2019, there were 31 breaches (compared with 20 in 2018) of the Code of Conduct. In both 2018 and 2019 there were no convicted cases of corruption at CLP, and 20 cases of whistleblowing (compared with 16 in 2018). The relatively higher number of breaches in the last several years reflects the improved identification and stricter enforcement of work place behaviour requirements.

None of the 31 breaches of the Code of Conduct in 2019 was material to the Group’s financial statements or overall operations. The breaches were mainly related to issues of workplace behaviour and individuals’ ethics and integrity. One of the reported Code of Conduct violations involved an employee at the grade level of senior manager and above.

Learn more about breaches related to Respect for PeopleLegal compliance

Compliance is a basic requirement for maintaining the social licence to operate. CLP’s commitment to comply with laws and regulations is specified in the Code of Conduct. There are additional policies, codes and guidelines that apply to operations and practices under the Code of Conduct including competition law compliance, compliance with personal data and privacy, health, safety and environmental (HSE) policies, and human resources policies, amongst others.

CLP is prepared to forego opportunity or advantage in order to maintain the highest standards of corporate governance and integrity. Beyond compliance, CLP voluntarily follows other standards that reflect the company’s principles and values.

Monitoring and follow-up

One of the responsibilities of the Audit & Risk Committee is to ensure that CLP is satisfying the compliance principles laid out in the Value Framework and the Code of Conduct, as well as compliance with applicable legal and regulatory requirements such as the Listing Rules, the Companies Ordinance and the Securities and Futures Ordinance. The Committee also reviews regulatory and legal cases. Every six months, Group Legal Affairs compiles a “CLP Group Key Regulatory and Legal Compliances Issues Report”, which covers key regulatory compliance issues in addition to legal cases in which CLP is a named defendant for the Board-level Audit & Risk Committee.

CLP is often confronted with changes in the legal and regulatory regimes that affects its operations. The company closely monitors emerging regulations, and ensures that it is prepared for new regulations before they become effective.

Accordingly, CLP reviewed new and amended laws and regulations which came into effect during the 2019 reporting year to identify those which have a significant impact on the business. The threshold applied for assessing the impact of new and amended laws and regulations is whether there is significant investment or expenditure required to ensure compliance. These aspects form part of this review, and the results are described in relevant sections of this report.

Emissions – air and greenhouse gas emissions, discharges into water and land, and generation of hazardous and non- hazardous waste

Employment – compensation, dismissal, recruitment and promotion, working hours, rest periods, equal opportunity, diversity, anti-discrimination and other benefits and welfare

Health and Safety – safe working environment and protecting employees from occupational hazards

Labour Standards – prevention of child and forced labour

Product Responsibility – consumer data protection and privacy

Anti-corruption – bribery, extortion, fraud and money laundering.

To uphold the spirit of transparency and accountability, CLP reports cases of legal non-compliance annually in the Sustainability Report. These include convicted criminal cases against CLP, and major breaches that resulted in significant fines (greater than HK$1 million) or non-monetary sanctions. CLP’s 2019 performance is summarised below, grouped based on the GRI Standards and the HKEx ESG Reporting Guide.

The Company is also exposed to the risk of contractual disputes and litigation in the course of its normal operations. The Group considers each instance separately in accordance with legal advice and will make provision and/or disclose information as appropriate. Refer to Note 30 – Contingent Liabilities in the 2019 Annual Report.

Reportable case of breaches in legal or regulatory compliance in 2019

Risk management

Risk Management Framework

Risk is inherent in CLP’s operations and the markets in which the Group operates. CLP aims to identify risks early so they can be understood, managed, mitigated, transferred or avoided. This demands a proactive approach to risk management.

CLP’s risk management framework comprises four key elements:

Risk management philosophy;

Risk appetite;

Risk governance structure; and

Risk management process.

CLP’s overall risk management process is overseen by the Board through the Audit & Risk Committee. There is a strong recognition that risk management is the responsibility of everyone within the Group. Therefore, risk management is integrated into all business and decision-making processes including strategy formulation, business development, business planning, capital allocation, investment decisions, internal control and day-to-day operations.

CLP's risk management objectives are two-tiered:

Strategic

At a strategic level, CLP focuses on the identification and management of the material financial and non-financial risks associated with the pursuit of strategic and business objectives. In pursuing growth opportunities, CLP aims to optimise risk and return decisions as defined and quantified through a diligent and independent review and challenge process.

Operational

At an operational level, CLP aims to identify, analyse, evaluate and mitigate all operational hazards and risks. This is done in order to create a safe, healthy, efficient and environmentally-friendly workplace for its employees and contractors. Other considerations include ensuring public safety and health, minimising environmental impact, and securing asset integrity and adequate insurance.

Risk management framework

Emerging risks

CLP recognises that certain external global trends could have a significant impact on its operating environment. These trends encompass significant political, economic, social, environmental and technological changes, and could rapidly evolve and impact on the context in which the company operates. Because of this, these trends are important in the process of identifying risks that could affect CLP's strategic execution and operational performance. Following a review of dozens of prospective megatrends in 2018 plus additional stakeholder engagement sessions conducted in 2019, CLP reaffirmed that purpose underpins the business as outlined in the CLP Group business section. In addition, the following four material topics were identified as priorities:

Climate change mitigation and adaption

Technology as an enabler and disruptor

Risks to cyber security and data privacy

Ever-changing operating environments require an agile, inclusive and sustainable workforce .

Going forward, CLP will continue to strengthen the integration of ESG risks into its risk management framework and processes, including how climate-related risks at the Group level are consolidated and assessed.

Read more about the key drivers and megatrends affecting CLPClimate change-related risks are embedded in these key risk areas and reported in the Risk Management Report of the Annual Report. In this Sustainability Report, CLP reports on how climate change impacts the Group’s business in the medium- to long-term. Additional information on climate-related risks is disclosed in the Risk Management Report and through CDP.

Find out more on climate scenarios analysis Read about how CLP responds to climate change Read more in the 2019 Risk Management ReportHolistic assessment of new investment projects

The CLP Group Investment Committee is mandated to review and assess acquisitions, investments, project funding, restructures and disposals proposed by the CLP Group. The Committee is made up of senior management and is chaired by the CEO.

Before major investments receive funding approval from the Investment Committee, they are subject to a multidisciplinary review process which includes both financial and non-financial components. Non-financial considerations include safety, security, social, climate change and environmental risks. Early assessment enables a reduction in the business and reputational risks associated with a project and helps guide stakeholder engagement.

Some financial institutions have adopted the Equator Principles to set minimum standards for determining, assessing and managing environmental and social risk. In 2019, around 50% of CLP’s new debt funding supporting Group investment projects with no recourse to CLP Holdings came from banks which have adopted the Equator Principles. This increased from around 40% in 2018.

Details of the non-financial review during pre-development and development of projects are summarised in the table below. For project execution and operation, on-going management is conducted in accordance with CLP operational standards and guidelines.

Health, Safety, Security and Environment management

HSSE Leadership

The CLP Group HSSE Management System Standard sets out a structured approach to HSSE risk management, which:

is executed through a set of standards and guidelines to meet the requirements of the policy statements set out in CLP’s Value Framework;

enables the Group’s regional organisations to incorporate HSSE requirements into their business programme; and

promotes and encourages compliance with the international standards for health and safety and environmental management such as ISO 45001 and ISO 14001.

The Standard contains 15 elements, each of which is supported by a set of expectations which encourage excellence in HSSE performance across the Group, while allowing some flexibility for implementation at a regional level.

The effectiveness of the HSSE Framework is reviewed and evaluated by the Board-level Sustainability Committee. CLP’s investment projects also undergo a variety of HSSE assessments. The results are presented to the Group Investment Committee, comprising of senior management and chaired by the CEO, to support decision-making.

Download the HSSE Management System Standard Download an overview of the safety and environmental management systems of CLP’s assetsGoals and targets

To support safe operations, the HSSE plan has clear objectives, programmes, timelines, and quantifiable Key Performance Indicators (KPIs), as well as sufficient resources including HSSE professionals and an appropriate budget.

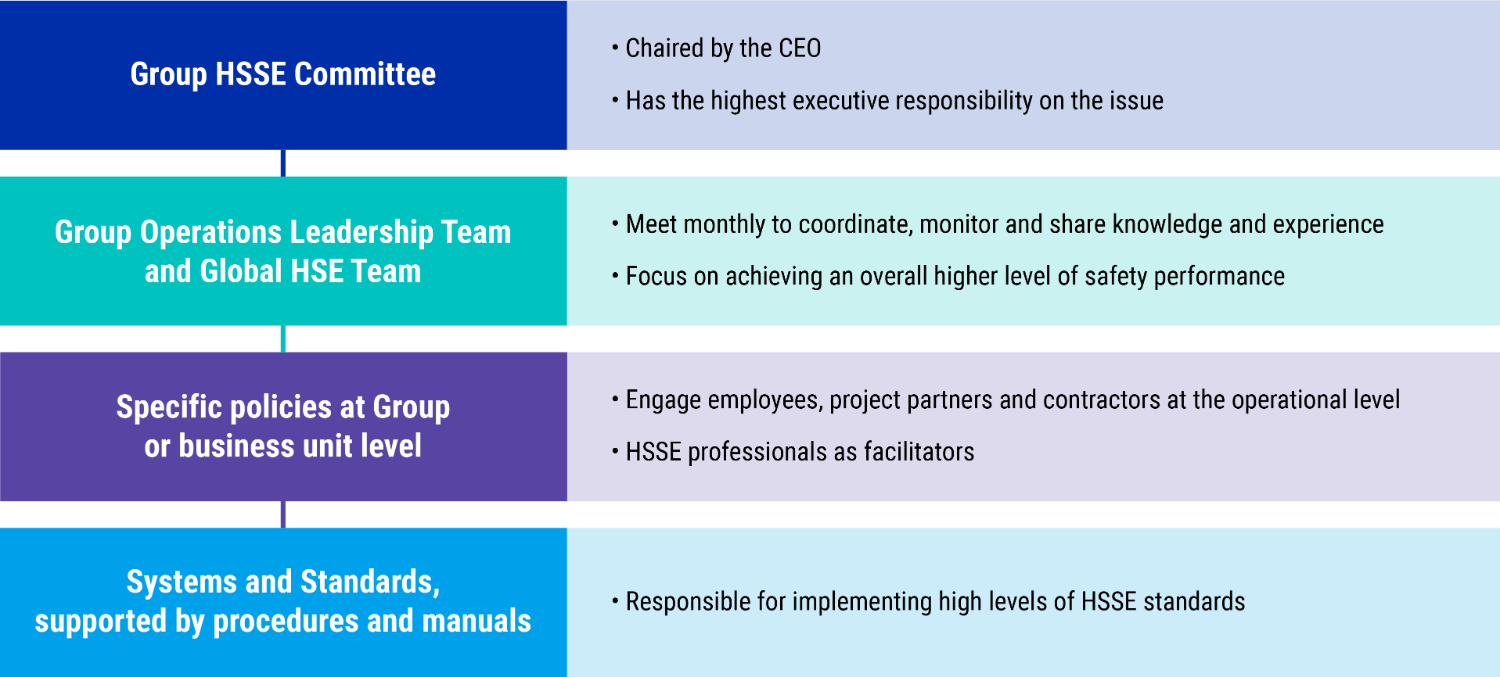

Operational responsibilities

The Group HSSE Committee, chaired by the CEO, has the highest executive responsibility on HSSE-related issues. The Group Operations Leadership Team and the Global HSE Team conduct monthly meetings to coordinate, monitor and share knowledge and experience in HSSE practices across the Group, with a special focus on achieving an overall higher level of safety performance.

In addition, various HSSE committees have been established to engage employees at the operational level, and this also involves project partners and contractors. HSSE professionals facilitate the overall engagement effort and advise on HSSE matters, while the responsibility for implementing high levels of HSSE standards rests with line management.

Continuous improvement

An annual HSSE improvement programme is developed, approved and communicated to staff and contractors in each region. Recommendations are implemented on agreed timescales and programme processes are monitored regularly.

Hierarchy of operational responsibilities

Occupational health and safety

The CLP Group’s HSE Improvement Strategy is based around five pillars, each of which emphasises a key fundamental principle for effective HSE management. It aims to uplift the Group’s safety culture across all operating regions, promotes more proactive risk management, and engages employees, contractors and other key stakeholders in collectively implementing changes to improve safety performance. CLP is committed to ongoing efforts to find new and better ways of working, by learning from investigations into incidents, as well as the adoption of best practices. For instance, the Group has implemented safety improvements for working at height and with other gravitational energies. In addition, Group-wide principles for the safety behavioural framework have been established which set expectations for all levels of the organisation. The Company is continuing to support behavioural safety observation programmes at key Group assets.

As part of Enterprise Risk Management, consistent standards continued to be implemented across the Group for risk management, which includes identifying risks and opportunities.

Download an overview of the safety and environmental management systems of CLP’s assetsGoals and targets

CLP is committed to ensuring all activities and operations result in zero harm for employees, contractors, customers and the public. The Group’s goal is zero fatalities and injuries for employees and contractors. CLP aspires to meet this target as part of its commitment to creating a healthy and safe workplace.

Monitoring and follow-up

The Safety Performance Monitoring and Reporting Standard sets out the safety performance indicators and requirements of safety data reporting. It utilises indicators to show trends which may require more attention to prevent an incident from occurring.

Safety performance is reported internally on a monthly basis. Safety performance data of the assets which fall within CLP’s safety reporting scope is collected and presented in the Group Operations Leadership Team and the Global HSE Team monthly meetings.

Training and awareness

Personnel will only be asked to do work in areas in which they are capable and competent to handle. This requires the careful selection, placement, training, ongoing competency assessment and authorisation of employees, with third-party independent assessment where appropriate. A system is in place to identify and deliver the training necessary to ensure individual competence and knowledge to understand the hazards, risks and control measures associated with their work.

At the asset level, they have the flexibility to structure their own Health and Safety organisations and to design more specific approaches in providing relevant health and safety training, as well as monitoring the percentage of contractors who have undergone the training. Safety training requirements are in all contracts and all contractors are expected to undergo safety training relevant to their duties. Spot checks are conducted to ensure compliance.

Continuous improvement

Thorough investigations have been conducted into all incidents with potential to cause serious injuries with the aim of identifying the root causes. CLP is also committed to understanding how behaviours drive safety performance and continues to support behavioural safety observation programmes in each region.

CLP’s Incident Management Standard sets out the minimum requirements for the implementation and maintenance of a safety incident management system across the Group. In the event of a major incident, the CLP Group Accident Investigation Panel (AIP) and Investigation Report Format Standard are followed. The AIP, chaired by senior members of staff from outside the business unit in which the accident occurred, conducts a thorough investigation. The AIP’s reports are critically reviewed by the Group Chief Operating Officer and the regional Managing Director. The intention is to identify root causes and contributing factors in relation to every incident, and ensure they do not occur again.

The Group is committed to improve its performance as guided by the HSE Improvement Strategy. The following charts show the safety performance of all CLP employees and contractors in the Group and individual regions in terms of the Lost Time Injury Rate (LTIR) and the Total Recordable Injury Rate (TRIR) in 2019. The total number of days worked by contractors and sub-contractors was approximately 3 million man days, assuming a nine-hour work day.

Improving HSE management

There are five pillars in the HSE Improvement Strategy, which emphasise key fundamental principles to effective HSE management. The critical theme across all pillars is a focus on reducing the number of serious incidents. Each pillar contains a number of elements which work together to deliver the Strategy in a cohesive manner. The Strategy is being implemented over a three-year period, with the focus initially on putting enablers in place, followed by the embedding and review of actions.

In December 2019, CLP undertook a review of the focus areas for the Strategy and concluded that these are the right drivers to deliver improved outcomes for the business. Examples from this year’s activities include:

Read the year's performance relating to Ensuring environmental sustainability

Read the year's performance relating to Ensuring environmental sustainability Safety around CLP’s network

While the Group’s HSSE Management System Standard sets out an overarching approach to managing the safety risks in operations, responsibility is also taken for preserving public health and safety, including for people who work or stay in proximity to electricity supply lines.

CLP operates a transmission and distribution network in Hong Kong and a transmission network in Shenzhen, Mainland China. In November 2019, a transmission network was also established in India. Working near electricity supply lines can pose public health and safety concerns. The Hong Kong and Mainland China operations conduct regular construction site inspections and provide cable plans and safety talks to road work contractors and site management personnel to enhance safety awareness in all locations. The Fangchenggang Incremental Distribution Network project has commenced operation in January 2020, and there will be continuous HSSE-related training and monitoring referencing CLP’s safety philosophy and best practices as appropriate.

EMF arising from the power system can be another public health concern. Power supply equipment fully complies with the guidelines issued by the International Commission on Non-Ionizing Radiation Protection (ICNIRP). Regular EMF measurements of power supply equipment are carried out jointly with the Electrical and Mechanical Services Department of the government. The measured EMF levels are well below the guideline limits.

Regarding customer health and safety, CLP Power has customer service centres conveniently located in its supply areas in Hong Kong to provide assistance in product safety, as well as advice on energy efficient products, energy saving tips and other account management issues for better quality living. In 2019, there were no reportable case affecting customer health and safety in Hong Kong.

Nuclear safety

Since 1985, CLP has held a 25% equity share in the Guangdong Daya Bay Nuclear Power Station (GNPS), which provides roughly 33% of the electricity supplied to CLP’s customers in Hong Kong. In 2017, CLP’s nuclear portfolio was expanded with a 17% equity investment in Yangjiang Nuclear Power Co. Ltd. which operates Yangjiang Nuclear Power Station (YNPS) in Guangdong. Nuclear power has proved to be a reliable, cost-competitive and clean source of energy. CLP continuously seeks investment opportunities for new capacity in low carbon energies such as nuclear, gas and renewables to realise the Group’s decarbonisation vision.

Nuclear risk management

The safe and steady operation of the two nuclear power stations is always the top priority. The defence-in-depth principle is applied across a full spectrum of areas from design, site selection, operation, radiation protection, environmental monitoring, to emergency preparedness. The safety principle of As Low As Reasonably Achievable (ALARA) is also applied to ensure robust radiation protection.

Through adoption of best international practices in its operation (e.g. IAEA Nuclear Safety Standards), a well-trained and qualified workforce, well-established safety practices and procedures, as well as risk analysis and mitigation, the two nuclear power stations have achieved good performances over a long period.

Download HKNIC’s brochure “Understanding nuclear power” Learn more about the contingency plan of GNPSNuclear waste management

GNPS follows national policy and international practices for nuclear waste management. GNPS stores its spent nuclear fuel onsite in a dedicated storage pool for each reactor. The back-end management of the fuel cycle remains on site for a number of years before being passed on to a service provider licensed by the Mainland Chinese Government for reprocessing. The service provider is supervised by the National Nuclear Safety Administration (NNSA) and its environmental impact is monitored by the Ministry of Ecology and Environment (MEE). The policy in Mainland China on reprocessing spent nuclear fuel is similar to that of a number of European countries.

As the minority owner of GNPS, CLP is not in a position to report the development of back-end management of the fuel cycle in China, including the status of the planned reprocessing plants for spent fuel.

Low- to intermediate-level solid radioactive waste is packed and stored in a dedicated facility onsite on an interim basis, and is secured to prevent unauthorised access. The waste is transferred to a final repository operated by a service provider, using the shallow burial method commonly adopted in the United States, France and the United Kingdom. The operation of the offsite repository is under the supervision of the national nuclear regulator and relevant nuclear safety regulations.

Monitoring and follow-up

Radiation exposure for workers is closely managed by plant operators both collectively and at individual level as part of operating protocols. Workers incur most of their radiation dosage during planned refuelling outages, when much of the work is undertaken at the nuclear generating units. The level of radiation dosage is typically associated with the number of planned outages carried out at the units, which require inspection and maintenance activities in radiation-controlled areas.

Training and awareness

An on-site training school provides professional nuclear training on operational procedures, which aim to enhance nuclear safety and systematically minimise human error. There is a once every two years requalification mechanism to ensure operators’ professionalism and competency in plant operation.

In line with good business practice, GNPS has also provisioned for the expenses associated with the future decommissioning of the plant as required by relevant laws and regulations.

The total quantity of nuclear waste from GNPS was higher in 2019 than in 2018 due to two planned refuelling outages carried out in the year, as opposed to one outage in 2018. The average dose rate in 2019 was less than 0.4 mSv per person per year. For the purpose of comparison, the background radiation dose rate for Hong Kong is 2.4 mSv per person per year from the natural environment.

The charts below show the amount of spent nuclear fuel and low- to intermediate-level radioactive nuclear waste from GNPS over the last several years. The amounts of both types of waste are related to the number of planned refuelling outages in each year.

Environmental management

The material environmental issues covered in the HSSE Framework and the Group-wide Environmental Policy include:

Environmental impact assessments

Environmental monitoring

Environmental management system development

Environmental due diligence

Data management systems.

Strategies and procedures

The Group HSSE Standard states that the environmental risks associated with a project’s operational life-cycle should be appropriately managed. As part of CLP’s Pre-investment Environmental Risk Assessment, an Environmental Due Diligence (EDD) is conducted at the project planning stage, followed by a more detailed Environmental Impact Assessment (EIA), during which air emissions and biodiversity assessments are conducted where applicable.

CLP takes great care in conducting all EIAs and is committed to fulfilling the requirements and recommendations stipulated in EIA reports and local regulations. There is also a process in place to ensure the EIA recommendations are implemented. Planning procedures extend beyond compliance in less developed countries, where regulations are not as mature. For instance, CLP mandates an EIA for all major generation projects in India, even though it is not a statutory requirement for renewable energy projects in the country.

The Environmental Management System Standard is a management tool that helps identify and manage significant environmental risks arising from operations. It also provides a systematic approach to continually improving the environmental performance of assets. CLP requires power generation assets over which it has operational control to achieve third-party certified ISO 14001 environmental management systems within two years from commencement of operation or acquisition. CLP is pleased to report that in 2019, all assets in this category have successfully certified their environmental management system to the ISO 14001: 2015 standard.

Monitoring and follow-up

The Group Operations Information System (GOIS) is a customised system to collect and manage data in relation to asset management, environment, safety and community initiatives. Its built-in data approval sequence and automated presentation and reporting functions strengthen data governance.

CLP recognises that the development of goals and targets can help monitor progress in using environmental resources efficiently. In 2019, the Group started to develop environmental targets for key environmental performance indicators. The data required to support these targets will be collected by the GOIS, enabling regular performance reviews.

CLP has also developed an Environmental Monitoring process to be applied at project level. It specifies how environmental conditions should be assessed and assists with the design and implementation of suitable measures.

Read about how environmental aspects are considered in new projects Download the environmental management systems of CLP's assetsEnvironmental regulations and compliance

It is fundamental that CLP fully complies with applicable environmental laws and regulations in the jurisdictions in which it operates. For new investments, established processes are in place to review relevant environmental requirements.

If an incident occurs at an asset under CLP’s operational control, it is classified and recorded in a timely manner in accordance with the internal process, including notification of any fines or prosecution from local authorities.

The increase in licence exceedances was largely due to the new and more stringent SO2 emission limit introduced since February for Jhajjar Power Plant.

Environmental regulatory requirements are becoming more stringent in many locations. CLP is monitoring these developments closely to prepare for the possibility of additional compliance requirements in future. Any licence exceedances and key emerging environmental regulations that could affect business units are listed below:

Key emerging environmental regulations

Hong Kong

Mainland China

All China assets under CLP’s operational control maintained full compliance with environmental regulations in 2019.

Since the issuance of “Opinions on Formulating and Strictly Observing Ecological Protection Zone” in 2017, 15 provincial-level regions have already set up their ecological "red line" zones, which aim to safeguard the ecological functions and prohibit any incompatible development project. In addition, a digital platform is being set up by the central government to monitor the ecological “red line” zones across the country. CLP continues to closely monitor the potential impacts on its assets and operations in relation to all relevant environmental regulations.

India

In India, further to the enforcement of the new SO2 emission limit by the end of January 2019, there were five minor licence limit exceedances for SO2 at Jhajjar Power Plant in the first half of 2019 but they did not result in any action by the local authorities.

In November 2018, the National Green Tribunal (NGT), a judicial statutory body established by the Indian government for adjudicating environmental cases, passed an order directing all thermal power plants, including Jhajjar, that did not dispose of all fly ash up to 31 December 2019, to deposit damages based on the capacity of the plant. A stay on the enforcement of the order was passed by the Supreme Court. A joint committee set up by the NGT to determine the penalty mechanism for non-compliance in relation to the order submitted its report in December 2019. While Jhajjar successfully disposed of all the ash generated since commissioning up to 31 July 2019, the implications of the report are currently being reviewed.

Deteriorating air quality continues to be a challenge in India and this has captured the attention of the public, the media and policy makers. Therefore, coal-fired power stations face stringent requirements on emissions of particulates, ash utilisation, NOx and SO2.

The Government of India recently announced the National Clean Air Program (NCAP) as a national level strategy to improve ambient air quality within a prescribed timeframe. Since the new air emissions limits at thermal power plants came into force in 2019, Jhajjar has overhauled the Flue Gas Desulphurisation (FGD), Electrostatic Precipitator (ESP) and bag filters to meet the new standards

CLP India actively participated in the Task Force on Clean Industry under the Clean Air Better Life initiative by the Confederation of Indian Industry and NITI Aayog. CLP India worked with relevant policy makers to promote the prioritisation of cleaner power procurement from energy providers who use advanced emission control technologies and cleaner fuels. With CLP India’s clean energy investments, the initiative and the potential regulatory change will offer competitive advantages, and will incentivise the utility sector to accelerate the use of cleaner technologies.

Australia

In Australia, two brief limit exceedances of NOx emission at Tallawarra occurred in February 2019 but did not result in action by the Environment Protection Authority (EPA). Corrective action was implemented during the station outage in 2019 to prevent a reoccurrence of such incidents. At Newport, there was one minor hydrocarbon exceedance to the wastewater treatment network under the Trade Waste Licence in February 2019. There were also two oil spillage incidents in March and August 2019 at Newport resulting in non-compliance. EPA Victoria was notified and no fines or penalties were imposed. Corrective actions have been taken to prevent a repeat of these incidents.

Victorian state environmental legislation and regulations are being revised and are expected to come into force from 1 July 2020. Yallourn, Newport and Jeeralang power stations are working to implement risk controls and ensure compliance with these new standards. In addition, CO2 emissions reduction targets may have implications for Yallourn power station and mine, and the Victorian Government is expected to finalise these targets by the second quarter of 2020.

Detailed site investigations of per- and polyfluoroalkyl substances (PFAS) in soil and groundwater for Jeeralang and Newport are underway and will be completed in early 2020. The findings will help to identify appropriate management actions as required under the Victorian environmental legislation.

Taiwan

In 2019, the effluent standards for power plants were revised under the Water Pollution Control Act which was further supplemented by revised regulations on water pollution control measures and test reporting management. The Ho-Ping Power Company (Ho-Ping), in which CLP has a 20% shareholding, is building a wastewater treatment plant in order to ensure compliance in its effluent quality with the revised standards. The treatment plant is expected to be in full operation in the first quarter of 2020.

Air Emissions

Air quality remains a challenge in many of the geographies in which CLP operates. As the Group expands its renewable and nuclear energy portfolio, air pollutant emission intensities have reduced. Nonetheless, further reductions on the net emissions from thermal power stations remain high on CLP’s agenda.

Strategies and procedures

CLP’s Power Plant Air Emissions Standard stipulates that any fossil fuel-based power plant developed after the effective date of the Standard is required to operate within CLP’s prescribed limits on sulphur dioxide (SO2), nitrogen oxides (NOX) and total particulate matter (total PM), or they must fully comply with local regulations, whichever is more stringent.

Apart from incorporating state-of-the-art air emissions mitigation measures into plant management processes, CLP also designs new power stations with advanced generation technologies that produce electricity as efficiently as technology allows, which assists in lowering emissions and greenhouse gases further.

Monitoring and follow-up

The Company continuously monitors air emissions (SO2/NOx /total PM) from facilities under its operational control using a continuous emissions monitoring system and/or stack sampling and mass-balance calculation methodologies. In addition, CLP regularly monitors mercury emission using stack sampling in accordance with local regulations.

Hong Kong

CLP Power Hong Kong has focused its efforts on reducing emissions by continually optimising the diversified fuel mix and maintaining the effectiveness of emissions control facilities. Despite a more than 80% increase in electricity demand since 1990, CLP Power Hong Kong has managed to reduce emissions of SO2, NOx and respirable suspended particulates (RSP) by more than 85%.

The emission allowances of CLP's power plants in Hong Kong have been progressively tightened over time. In 2010, the Hong Kong Government introduced emission allowances under the first Technical Memorandum (TM) of the Air Quality Control Ordinance. Since then, the emission allowances for SO2, NOx and RSP have been tightened by 68%, 38% and 37% respectively. In 2019, the SO2 emission allowance was further tightened by 4% from the very tight base of 2018. CLP Power Hong Kong has fully complied with these targets.

From April 2019 onwards, CLP Power Hong Kong began to measure and report mercury emissions in compliance with the new emission limit for the Castle Peak Power Station. All the measurements in the year were well below the limit, achieved through maintaining the effectiveness of emission control equipment and the control of the mercury content in coal. CLP Power Hong Kong is also aware of the high global warming potential of sulphur hexafluoride (SF6), an insulating gas commonly used in switch gears and transmission lines, and is vigilant in the control of SF6 leakage throughout the life cycle of electrical equipment.

Mainland China

The Fangchenggang Power Station continued to perform well after the completion of the upgrade in emission control equipment for SO2 and NOx. In addition, a pilot project is underway to use the CO2 from flue gas to cultivate microalgae. This will in the future offset some CO2 emission from the plant.

India

CLP India has further reduced SO2 emissions from Jhajjar Power Plant, and upgraded its continuous emission monitoring system (CEMS) to improve accuracy in measurement.

Australia

The Tallawarra Power Station upgraded its continuous emissions monitoring system (CEMS) in 2019 to ensure the plant had the most accurate data for keeping emissions as low as possible. Mt Piper installed a CEMS unit as part of a programme to improve emissions monitoring and performance.

CLP India contributes to air quality improvement

In addition to the emission control projects in the Jhajjar Power Plant, CLP India has partnered with the CII Foundation on a community programme to encourage local farmers to adopt sustainable methods of crop residue management in Haryana.

The two-year project will cover an estimated 9,000 acres of farmland and will initially be implemented in six villages in the districts of Rohtak and Fatehabad in Haryana.

The project is being executed with the help of local non-profit partners and farmer groups. It includes a series of community engagement campaigns to raise awareness and capacity amongst farmers for adopting sustainable and eco-friendly methods of straw management. In the second phase of the project, farmers have been provided with in-situ crop residue management farm tools and technologies for better straw management.

The programme will provide financial support to farmer groups for procuring or hiring high-powered tractors (required for operating in-situ machines) and balers (for clearing straw from the field if there is no scope for in-situ straw management). These machines cut the crop residue, mix them with soil to improve soil health, and plant the seeds for the next batch of crops, thereby saving time, energy and money as compared to conventional methods.

Crop residue burning not only contributes towards harmful emissions, but also depletes essential nutrients from the soil. The project aims to stop crop residue burning in the state, which is a fundamental change in the farming practices in the region, thereby improving the local air quality.

Read more on how CLP India helps tackle air pollution

Stubble burning generates heavy smoke and worsen air pollution

Waste

Strategies and procedures

CLP endeavours to reduce both the hazardous and non-hazardous waste it produces, and works with qualified parties and partners to reuse or recycle whenever possible. All wastes are managed according to the waste management hierarchy (i.e. prevent, reduce, reuse, recycle, replace, treat and dispose). CLP seeks to avoid the use of hazardous materials and replace them with alternatives wherever possible. All hazardous and non-hazardous wastes are managed in accordance with local regulations, collected by licensed collectors, or sold for recycling. Waste generated from renewable assets is also managed in the same manner.

At CLP’s coal-fired power stations, coal ash from coal combustion and gypsum from the flue gas desulphurisation process constitutes the majority of generation by-products. The aim is to use them as a resource for construction and other applications in line with local regulations and practices rather than disposal.

Monitoring and follow-up

CLP monitors its waste generation monthly by tracking solid and liquid forms of hazardous and non-hazardous waste produced and recycled at its facilities.

CLP continued to sell its generation by-products such as ash and gypsum for use in other industries where feasible. The Group’s power stations run different programmes to manage waste, and learnings are shared with both colleagues and contractors to raise awareness and build capacity. Key programmes in 2019 included:

Jhajjar Power Plant: CLP India has been taking enhancement measures in its ash handling system and actively seeks ash utilisation opportunities with other industries such as road construction, cement plants and brick-making plants. In 2019, Jhajjar achieved 100% utilisation rate of the ash generated, and furthermore cleared all the ash stored in the ash dyke.

Jinchang Solar Power: CLP China continues to utilise the initiative from solar panel manufacturers to take back any damaged panels for recycling.

Fanchenggang Power Plant: CLP trialled using white mud, a by-product generated by a paper mill factory, to partially replace the use of limestone in the plant’s flue gas desulphurisation process. Around 5,300 tonnes of white mud was used in the trial, reducing use of raw materials in plants and solid waste production from the paper mill.

CLP Power Hong Kong: Single-use polyfoam meal boxes in staff canteens were all replaced by corn-based biodegradable products, reducing the use of around 26,000 single-use plastic meal boxes a year.

Water

Strategies and procedures

The quantity of water withdrawal and discharge in CLP’s operations is dominated by thermal plants using once-through seawater cooling. In this process, large quantities of seawater are used for cooling and returned to the sea with only a slight increase in water temperature. The total volume of water withdrawal and discharge is dependent on the total electricity generated.

Where freshwater is withdrawn for operations, CLP strives to reduce water use and reduce the freshwater intensity of the electricity generated. It is also important to ensure water availability in these plants to ensure operations will not be disrupted.

Monitoring and follow-up

The Company assesses water availability in the planning stage of projects including the likelihood of water scarcity in the future and during plant operations. Engaging with and understanding the needs of local stakeholders is also prioritised, to ensure the licence to operate is maintained. As a result of the water treatment processes put in place, none of CLP’s operations significantly impact their respective water receiving bodies.

Also carried out at the planning stage of development projects are water quality impact assessments, in accordance with local requirements. This is to ensure that any impacts associated with the project construction and operation are managed and mitigated to an acceptable level.

In-depth assessments on water risk in the generation portfolio are conducted regularly, including using globally recognised tools such as the World Business Council for Sustainable Development (WBCSD) Global Water Tool and World Resources Institute (WRI) Aqueduct. The assessment covers parameters such as water availability, water sensitivity, water stress mapping, potential competing use with other stakeholders, and the management strategies in place in each of the regions. The results of the assessment confirmed that CLP has a sufficiently robust regime in place for managing water risks.

CLP also participates in the CDP water survey to disclose and benchmark its practices with industry peers in relation to water resource management. The company is committed to continuing to monitor its water use and manage this precious resource carefully.

CLP’s power stations, in particular the fossil-fuel fleet which uses more water, carry out a range of water conservation initiatives depending on site conditions, operational situations and age. The amount of water which can be recycled depends on factors such as location, power station design, and regulatory requirements. CLP encourages its power stations to track their total water recycling and report this for indicative purposes. Considerable emphasis is placed on sharing initiatives across the CLP Group to maximise the benefit of an individual power station’s efforts.

Three of the CLP Group’s thermal power stations, Fangchenggang, Jhajjar and Mount Piper, operate on a zero liquid discharge basis. The water is treated internally and recycled or reused in other parts of the power generation process, or for dust control or horticulture. For instance, the Fangchenggang Power Station in Mainland China uses treated greywater to reduce the use of freshwater in the flue gas desulphurisation process. The Jhajjar Power Plant in India operates on the basis of using river water with limited or no water discharge. It is designed with a water re-circulation process, requiring limited quantities of water to be topped up to make up for evaporation losses. In June 2019, CLP India received the Second Runner Up Jury Special Mention Award in an award programme organised by Frost & Sullivan and The Energy and Resources Institute for the Jhajjar plant’s achievements in water management.

In Australia, construction of the new 14 km water transfer pipeline and water facility to support the long-term operation of the Mount Piper Power Station was completed in 2019. Since commissioning, water is sourced from the nearby Springvale mine to augment cooling water supplies to the power station. Consequently, the operation of the station will no longer require water from local catchments for its cooling system and therefore there will be no discharge from the mine into the local river systems.

CLP’s solar farms seek to achieve zero-water for cleaning

CLP’s solar farms require water, although in relatively small quantities, for cleaning purposes.

Manual cleaning is the most widely adopted method. However, depending on site conditions (e.g. swamp areas) this may pose safety risks to the cleaners. Cleaning during the daytime also reduces the productivity of the plant.

The Group is currently exploring innovative technology to achieve low water use targets for dust removal on solar panels. In 2019, CLP completed a pilot project to use robotic cleaning which uses brushes instead of water for cleaning of solar panels in the Sihong and Veltoor solar farms in Mainland China and India. These projects did not only achieve zero use of water for cleaning, but could also potentially increase the efficiency of electricity generation. These successes set a precedent for the wider deployment of the technology in the future.

Dry cleaning robot in Veltoor solar farm in India.

Biodiversity and land use

Goals and targets

The Group’s goal is "no net loss of biodiversity". Targets are site-specific depending on the different levels of regulatory controls on biodiversity, from assessment requirements to ecological compensation. For example, the target is a net gain in the habitat hectare score at the Yallourn mine’s programme in Victoria.

Strategies and procedures

In addition to implementing an internal Environmental Impact Assessment (EIA) standard that mandates an environmental assessment for all new projects, the Biodiversity Impact Assessment Guideline provides a framework for a more systemic assessment of biodiversity impacts. The Guideline under the HSSE management system is applicable to power generation, transmission and distribution, mines and other power-related projects.

During the EIA stage, CLP partnered with qualified personnel to conduct biodiversity impact assessment. The Biodiversity Impact Assessment Guideline provides guidance on managing biodiversity risks where appropriate, and considers the IUCN Red List of Threatened Species and national conservation lists of threatened species. Any new operations that could affect the IUCN Red List of Threatened Species and national conservation list species are flagged well ahead of any investment decision. The assessment also describes the baseline conditions, evaluates the magnitude and significance of project impacts, and investigates options for mitigation. If necessary, the assessment contemplates offsets after considering options relating to avoidance, minimisation, and restoration or rehabilitation. The assessment also observes local legislative requirements and references the International Finance Corporation Sustainability Framework.

See CLP's holistic approach in assessing new investmentBiodiversity

Much of the biodiversity work across the Group is ongoing. This includes activities such as vegetation management along transmission lines in Hong Kong, the fish management regime in place at the Jiangbian hydro power station in Mainland China, and the tree management work undertaken by the Jhajjar Power Plant in India.

For the transmission and distribution network in Hong Kong, CLP closely monitors the growth and the condition of trees and vegetation in the vicinity of overhead lines and has a tree inventory to identify any hazardous trees which will affect the overhead's lines operation. To support the Hong Kong Government’s Strategy of "Right Tree in the Right Place", any hazardous trees identified will be replaced with native species to support local biodiversity.

The Hong Kong Offshore LNG Project, further to the Environmental Impact Assessment (EIA) approval obtained in October 2018, has commenced marine mammal baseline surveys since June 2019 in the southern and western Hong Kong waters to establish the baseline conditions of the Chinese white dolphins and finless porpoises as part of the Environmental Monitoring & Audit programme.

In Mainland China, the Xundian wind farm has completed its 3-year post-commissioning bird monitoring of the nationally-protected species, black-necked crane. The monitoring was conducted in accordance with the EIA recommendation which considered that the project location is in the vicinity of the black-necked crane provincial nature reserve. Monitoring results together with the expert review panel concluded that there has been no direct impact on the birds due to the operation of the wind farm.

At the Mt Piper Power Station in Australia, CLP has received approval to build the Pipers Flat Rail Coal Unloader to supply the power station with new sources of coal. CLP is also establishing a permanent biodiversity offset area which will improve the long-term biodiversity values of the rail unloader offset site. The biodiversity offset site is close to the power station and the habitats protected include grassy woodlands and dry forests.

Land remediation

The Wallerawang power station in New South Wales continues to progress to the completion of the demolition and rehabilitation of the site. The power station internals have largely been removed. Demolition has been approved and relevant material will be disposed of in an approved new asbestos disposal area. Clean fill from a tunnel project in Sydney has been secured and will be imported to the site to act as capping material for Wallerawang power station assets.

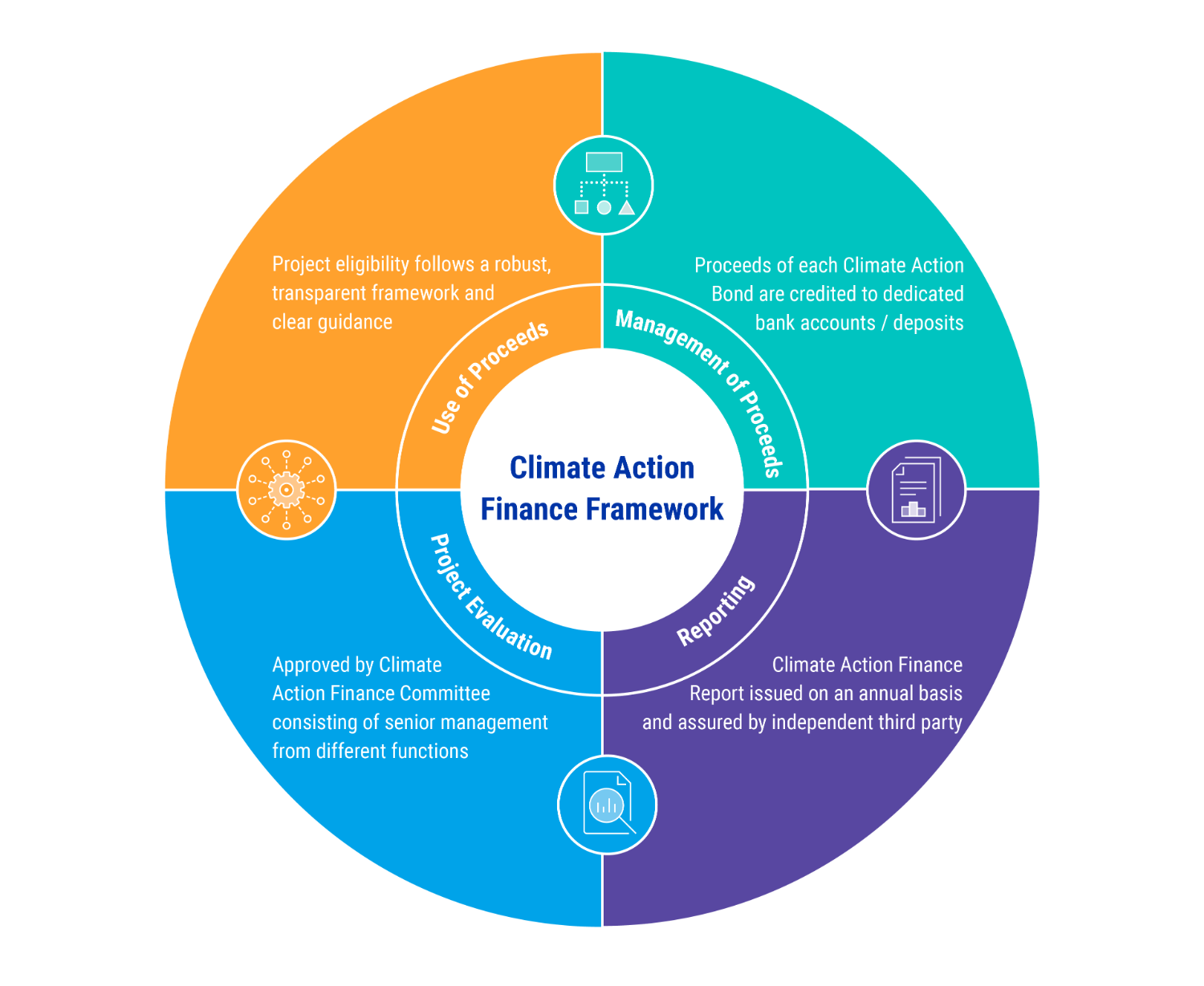

Climate action finance

Strategies and procedures

The Climate Action Finance Framework (CAFF) supports the transition to a low carbon economy by attracting socially responsible, sustainable financing. It supports CLP’s investments in reducing carbon emissions and increasing energy efficiency. Established in July 2017, the CAFF sets out how CLP proposes to raise climate action bonds (CLP Climate Action Bonds) to invest in projects consistent with both the Group’s investment and climate strategies. CLP Group’s majority-owned business units may issue bonds under the CAFF, and there are two types of Climate Action Bonds:

New Energy Bonds – the proceeds of which help develop renewable energy, energy efficiency and low emissions transportation infrastructure projects

Energy Transition / Emission Reduction Bonds – the proceeds of which help develop gas-fired power plants to support the transition from coal-fired generation in markets with limited renewable energy resources.

New Energy Bonds are aligned with the Green Bond Principles, which provide guidance in four key areas: the use of proceeds, the process for project evaluation and selection, the management of proceeds as well as reporting. Energy Transition/ Emission Reduction Bonds are aligned with the governance components of the Green Bond Principles, including the process for project evaluation & selection and management of proceeds & reporting.

Operational responsibilities

All eligible projects of the CAFF undergo a rigorous review and approval process within a transparent framework and clear guidelines. CLP has established a Climate Action Finance Committee with the responsibility for governing the CAFF. The Committee is responsible for approving the issuance of Climate Action Bonds and determining the eligibility of the proposed use of proceeds. Committee membership consists of the CLP Executive Director and Chief Financial Officer, and senior management from the sustainability, finance and legal departments.

Monitoring and follow-up

All bond proceeds must deliver clear environmental benefits through investment in qualified projects identified by a transparent screening process. Controls are also in place to ensure that bond proceeds are only used for designated green projects. CLP produces a Climate Action Finance Report annually to help track the appropriate use of bond proceeds and provide insight into their estimated environmental impact. The content of the report is independently assured by an auditor.

Climate Action Finance Framework

The first Climate Action Bond was issued in July 2017. In 2019, CAPCO issued the second bond under CAFF as a HK$170 million 25-year fixed rate New Energy Bond to fund the construction of the West New Territories Landfill energy-from-waste project in Hong Kong. This was the inaugural green bond for CLP’s Scheme of Control business. The energy-from-waste project allows CAPCO to utilise landfill gas as an energy source to offset its coal-fired power generation and reduce emissions from coal burning.

Download CLP's 2019 Climate Action Finance Report Download the Indepdent Assurance Statement for the 2019 Climate Action Finance ReportGreenhouse gas emissions

The GHG intensity of the electricity CLP generates is one of the targets in the Company’s Climate Vision 2050. A Group-wide GHG reporting guideline was first developed in 2007. CLP is reporting GHG emissions with reference to the following international standards and guidelines:

The Greenhouse Gas Protocol: A Corporate Accounting and Reporting Standard (Revised Edition) of World Business Council for Sustainable Development (WBCSD) and The World Resources Institute (WRI)

The Greenhouse Gas Protocol: Corporate Value Chain (Scope 3) Accounting and Reporting Standard

The Greenhouse Gas Protocol: Technical guidance for Calculating Scope 3 Emissions (Version 1)

IPCC Guidelines for National Greenhouse Gas Inventories, 2006

IPCC 5th Assessment Report, 2014

International Standard for GHG Emissions ISO 14064-1

CLP obtains emission factors from the local governments and authorities in jurisdictions where the different business units operate. In cases where local emission factors are not available, other recognised sources are referenced.

CLP’s GHG emissions inventory covers the six GHGs1 specified in the Kyoto Protocol. Nitrogen trifluoride (NF3), the seventh mandatory gas added under the second Kyoto Protocol, was also considered for inclusion, but after evaluation was deemed immaterial to operations.

Scope 3 GHG emissions

CLP has been focused on measuring its Scope 1 GHG emissions as that is the main emission type from its generation business. Conscious of emissions along the value chain, in 2019, the Company conducted a comprehensive review of its Scope 3 emissions, and from this report onwards will add disclosure of Scope 3 emissions to present a more comprehensive view of its footprint along the value chain.

Conducting a Scope 3 screening exercise is the first step to understanding all sources of emissions and identifying the material categories for reporting. Like many industries, electric utilities may have limited influence or control over some Scope 3 emissions categories. CLP will monitor its Scope 3 emissions particularly if they represent an increasing portion of the total carbon footprint.

Goals and targets

As presented in CLP’s Climate Vision 2050, the decadal carbon intensity targets have been strengthened in 2018 to reflect the increasing pace of transition in key markets and globally. CLP also created targets for renewable energy and non-carbon emitting generation.

Learn more about CLP's GHG emissions goals and targets in Climate Vision 2050Monitoring and follow-up

CLP manages the GHG emissions from its generation business by adopting a rigorous Asset Management Framework. Asset performance metrics are utilised and established Engineering Standards and Guidelines are applied, aligning with operational protocol for delivering reliable electricity.

The internal GHG emission reporting guideline is reviewed in accordance with CLP practice at least once every three years.

CLP has been disclosing the combined total Scope 1 and Scope 2 GHG emissions on an operational control basis for more than a decade. This compilation basis represents the total GHG emissions from generation assets where CLP has direct influence and control on operational matters. This will continue to be disclosed for better year-on-year comparison.

At the same time, a better reflection of CLP’s investments in decarbonisation efforts is gauged through GHG emissions based on equity and long-term capacity and energy purchase. Purchase agreements help the Group meet local market needs and usually entail significant investment. In addition, this figure allows customers to better understand the carbon intensity of the electricity CLP provides. In order to qualify for inclusion in this metric, these long-term capacity and energy purchase agreements must have a duration of at least five years and the equivalent capacity of 10MW or more.

Progress of Climate Vision 2050

Under the new reporting basis of including long-term capacity and energy purchase agreements, CLP’s progress against its CV2050 targets are summarised below. Intensity measured on an equity only basis continues to be reported to allow for year-on-year comparisons.

Scope 3 emissions of CLP

Fuel- and energy-related activities were identified as the most material for CLP among the 15 categories of Scope 3 emissions, followed by Use of Sold Products and Capital Goods. These three categories account for around 90% of CLP’s Scope 3 emissions.

CLP's view on Hong Kong’s Decarbonisation Strategy

Land constraints and the densely populated nature of developable land in Hong Kong have always posed a challenge for the city’s deployment of large-scale renewable energy projects.

While taking this into consideration, CLP issued a public response to The Council for Sustainable Development’s public engagement on the Long-term Decarbonisation Strategy launched in June 2019, expressing support to the need for deep decarbonisation of electricity generation. CLP’s response highlighted the challenges and opportunities of different pathways to increase long-term low-carbon electricity generation and/or source more zero-carbon energy through regional cooperation. The potential opportunities associated with latest technologies such as zero-carbon hydrogen or carbon capture and storage were also discussed.

Download CLP Power’s response to the consultation paperCLP’s response aligns with the Five-year Development Plan (2018-2023) which outlines a focus on gradually migrating to a generation fuel mix composed mainly of natural gas while reducing the use of coal in electricity generation. The Development Plan also highlights several important capital projects crucial to accelerating CLP’s transition to lower-carbon energy, including the new 550MW gas-fired generation units at the Black Point Power Station and the construction of the offshore liquefied natural gas (LNG) terminal that will provide a more secure long-term alternative source of natural gas. It also includes the landfill gas power generation system at the West New Territories Landfill in Hong Kong, as well as the enhancement of the Clean Energy Transmission System connecting the CLP grid to Guangdong. Find out more here.

Preparing for carbon trading

Negotiations on carbon trading at COP25 were focused on Article 6 of the Paris Agreement, with a view to creating a new financial instrument that would enable a transparent trading mechanism for countries to meet national emissions reduction pledges. Challenges remain for negotiators to agree on a framework that will be flexible enough to attract investment while alleviating uncertainty as to how Clean Development Mechanism (CDM) credits, a legacy of the Kyoto Protocol that laid out the rules for a global carbon trading mechanism, would transfer to the new scheme under Article 6.

The Mainland Chinese Government officially announced the establishment of a national Emissions Trading Scheme (ETS) in December 2017. In the initial phase, the national ETS covers only the power sector with a view to gradually expanding to other key emitting sectors. Throughout 2019 the Government focused on the development of market infrastructure. The Ministry of Ecology and Environment (MEE) successively released draft regulations of the national ETS for comments and organised a series of training workshops across the country to provide carbon management knowledge and test allocations for the covered entities. In response, CLP China set up a dedicated carbon management team to monitor its carbon portfolio in Mainland China and the development of the national ETS. The Group’s assets are making appropriate preparation for the upcoming carbon market, including the Fangchenggang Power Station, to monitor, report and verify its carbon emissions.

The Government of India has not yet made an announcement pertaining to any domestic compliance and carbon trading schemes. Currently, all renewable energy generation projects of CLP India are registered in Clean Development Mechanism (CDM) and Voluntary Carbon Standard (VCS), and carbon offsets generated from these projects are being traded in the international markets. CLP India is still operating one coal-fired power plant in Jhajjar, Haryana, and is continuing to closely monitor the development of the domestic carbon trading scheme of the national carbon market in India.

CLP has not adopted an internal price on carbon, as this is not foreseen as being strategic for the Group to accelerate its decarbonisation journey. As outlined under CLP’s Climate Vision 2050, clear targets have been set that help shape current and future investment decisions. As part of this commitment, the Company is strictly focused on expanding its portfolio of renewable and non-carbon assets, coupled with an increasing focus on transmission and distribution as well as new business opportunities presented by the Group’s innovation team. An internal price on carbon would not impact or change the Company’s investment decisions.

For the existing portfolio of thermal assets, as outlined above, CLP is tracking the development of domestic and international carbon markets and is making appropriate provisions to prepare for this eventuality. More importantly, the company’s thermal assets are already slated to be phased out from the portfolio, and adding an additional complexity of an internal carbon price would not accelerate this decarbonisation trajectory.

Climate resilience

Extreme weather events are perhaps the most visible and imminent risk that arises from climate change. Recent years have seen many high-impact events including typhoons, floods or droughts, heatwaves and bushfires around the world. These events can cause physical damage to CLP’s assets and operational disruption, which in turn, can result in reduced output, increased repair and maintenance costs, and service disruptions for customers. It is critical that CLP’s systems are resilient enough to withstand extreme conditions to minimise disruption and to help facilitate faster recovery for affected communities.

Aside from direct physical damage, climate change can also adversely impact the company’s operations in other ways. For instance, shifts in rainfall and drought patterns may reduce the availability of raw water for some power plants. Damage to assets along the supply chain, in particular the procurement of fuel, is another way that extreme weather events may affect the Group’s ability to reliably deliver electricity.

In response, CLP has put in place adaptation or mitigation measures appropriate for each of its markets. These are summarised below.

Asset management

Strategies and procedures

CLP’s Asset Management System (AMS) Standard was developed in 2016 to standardise key practices in asset management across the Group. It sets out a framework to ensure best practice is followed based on the ISO 55000 series of standards for asset management as well as the ISO 31000 standards for risk management.

The AMS Standard is integrated into CLP’s Health, Safety, Security and Environment (HSSE) Management System and the Project Management Governance System (PMGS) Standards to manage the complete lifecycle of an asset. The AMS contains five key stages and ten asset management elements, as illustrated in the diagram below.

Monitoring and follow-up

CLP has developed and implemented a non-financial data reporting and assurance standard in-house. Relevant staff at asset, regional and Group level are expected to take responsibility for upholding the standard. The customised Group Operations Information System (GOIS ) is used to compile operational data. It facilitates data collection and approval and reduces the chance of human error.

Continuous improvement

CLP constantly identifies opportunities to improve the operational efficiency of all Group assets, which help meet the increasingly stringent regulations on emissions and fuel efficiency in certain jurisdictions.

Initial efforts at the project planning stage are critical in determining the operational efficiency or capacity factor range of an asset through its entire lifespan. Projects involving a major asset overhaul require stringent technical and financial scrutiny before commencement.

Opportunities arising from innovation and optimisation, particularly from big data and data analytics are also increasing, with a wide range of potential applications including performance enhancement. Find out more here.

Overview of CLP’s asset management

Generation assets

The decrease in coal consumption was primarily due to the decreased output from Mt. Piper in Australia, Jhajjar in India and Castle Peak in Hong Kong. The increase in gas consumption was mainly due to increased production at Tallawarra in Australia and Black Point in Hong Kong.

Examples of operational efficiency improvement projects at CLP Group assets can be found here:

Find out how innovation improves CLP Group's operational performanceCLP reports the annual operating performance of its generation portfolio for those assets which fall within the reporting scope. The performance metrics include the availability factor, generation sent-out, thermal efficiency and energy intensity.

Download CLP’s asset performance statisticsTransmission network

To meet Hong Kong’s electricity demand growth, CLP reviews future transmission network developments annually in accordance with the latest system maximum demand forecast, area load growth, infrastructure development and generation development. Maintenance and improvement programmes have been developed annually for major assets, based on the analysis of current conditions and performance of assets, level of investment and risk.

CLP continues to improve the reliability of its power supply network. In addition to vegetation management and third-party damage prevention programmes, various measures are taken to further enhance network reliability and minimise customer supply interruption. Examples include:

Installing on-line condition monitoring systems for switchgear and transformers to allow real-time monitoring and detection of incipient fault conditions

Continuing the reinforcement of towers for 400kV overhead lines against super typhoons and the refurbishment of switchgear

Enhancing automatic detection and isolation of faulty sections of overhead line circuits and expediting deployment of smart meters in villages

Conducting regular reviews and targeted studies on network performance to drive continual improvement.

Making clean energy accessible in India

CLP India successfully entered into the transmission sector in 2019.

CLP India has taken action to make low carbon and clean energy accessible through infrastructure development and investment in the transmission sector.

CLP India entered into an agreement with Kalpataru Power Transmission Ltd. to acquire three of its power transmission assets in 2019. One of the three projects, Kalpataru Satpura Transco Pvt. Ltd. (KSTPL), was successfully transferred to CLP India in November 2019, marking the company’s entry into the transmission sector. Procedures and guidelines in line with CLP Group standards are being implemented to ensure enhanced operational practices and improved safety standards in the newly acquired transmission assets. CLP India will continue to explore opportunities to expand its transmission portfolio in the coming years.

Pursuing opportunities in Mainland China

The Mainland China Government has been restructuring the energy market through regulatory changes and the introduction of more competition. CLP is actively pursuing opportunities from marketisation and smart energy development in Mainland China.

Through TUS-CLP Smart Energy Technology Co. Ltd. (TUS-CLP), CLP’s joint venture with TUS-Holdings which is affiliated to Tsinghua University, CLP participates to build and operate an incremental distribution network (IDN) at the Fangchenggang High-Tech Zone. This project is CLP’s first investment in distribution grids in Mainland China and will set a solid foundation to expand into similar opportunities in southern China as reform of the electricity sector continues.

The Outline Development Plan for the Greater Bay Area released by the Central Government in 2019 makes the development of smart cities in the region a key focus. In response, CLP has set up a dedicated team to work closely with partners to pursue opportunities in this important emerging sector, with smart energy development a priority. CLP’s active participation will contribute to sustainable business growth and to the long-term development of the electricity sector in Mainland China.

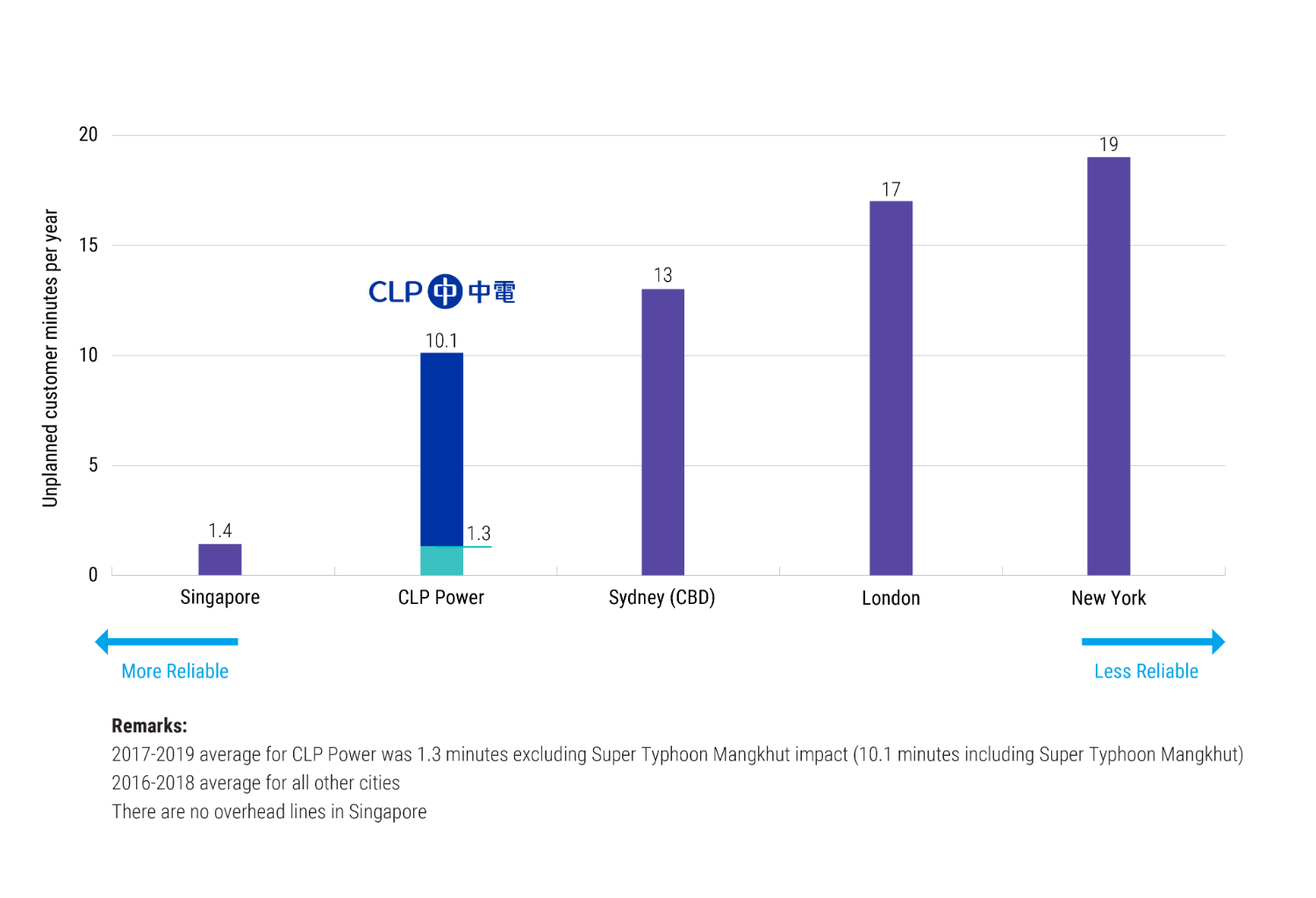

Availability and reliability

Goals and targets

Targets for each asset are set annually and included in the business plan. Performance is reported on a weekly basis to senior management. Any significant variations to plans are analysed and corrective action is taken where appropriate.