Purpose

The history of CLP mirrors the economic development of Hong Kong and the growth of the Asia-Pacific region. CLP cares not only about shareholders, but also about the communities where it operates.

As an operator and investor in the energy sector in Asia-Pacific for over a century, CLP has been at the forefront of major transformations in the industry and how it serves the markets of the region. In the company’s home market of Hong Kong, where CLP was incorporated in 1901, the city has been transformed from a bustling port to a dynamic metropolis on the world stage.

Although the circumstances and CLP’s role in each of its markets differ, the Group has an unwavering commitment to its communities:

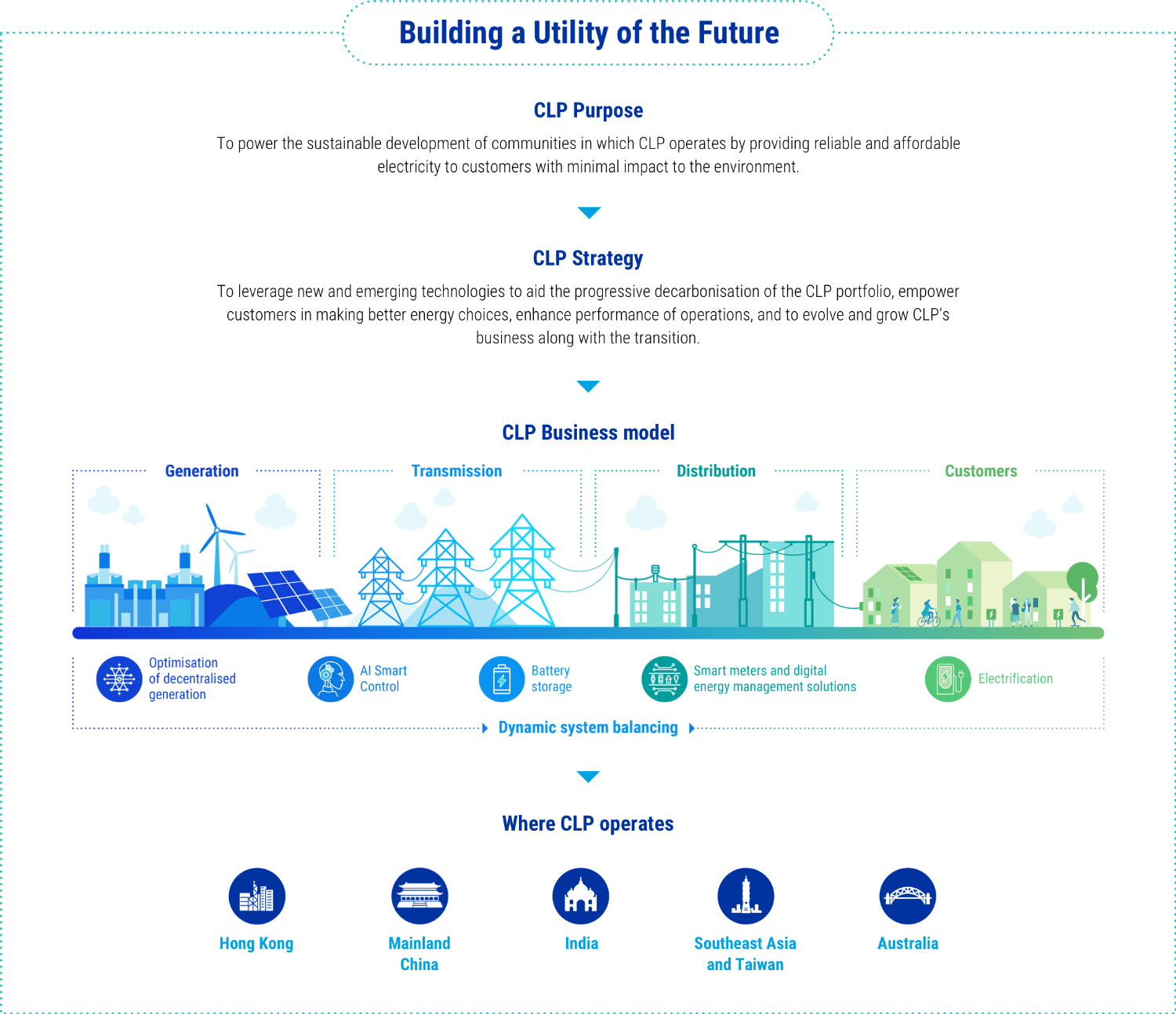

“CLP aims to power the sustainable development of communities in which we operate by providing reliable and affordable electricity to our customers with minimal impact to the environment.”

In delivering service, CLP values guide the company's behaviour:

“CLP cares for people, the community and the environment. We care about performance, respect laws and standards and value innovation and knowledge.”

The pivotal role of electricity for economic growth and human development cannot be over-emphasised. It is essential for modern infrastructures such as water supply, healthcare, transport and digital technology. Worldwide, 9 out of 10 people now have access to electricity. As CLP operates primarily in developed or emerging economies where access to electricity is almost universal, stakeholders expect more than simply the delivery of safe and reliable energy services.The Company strives to ensure that its electricity is affordable and that it minimises the impact on the environment, in particular greenhouse gas emissions.

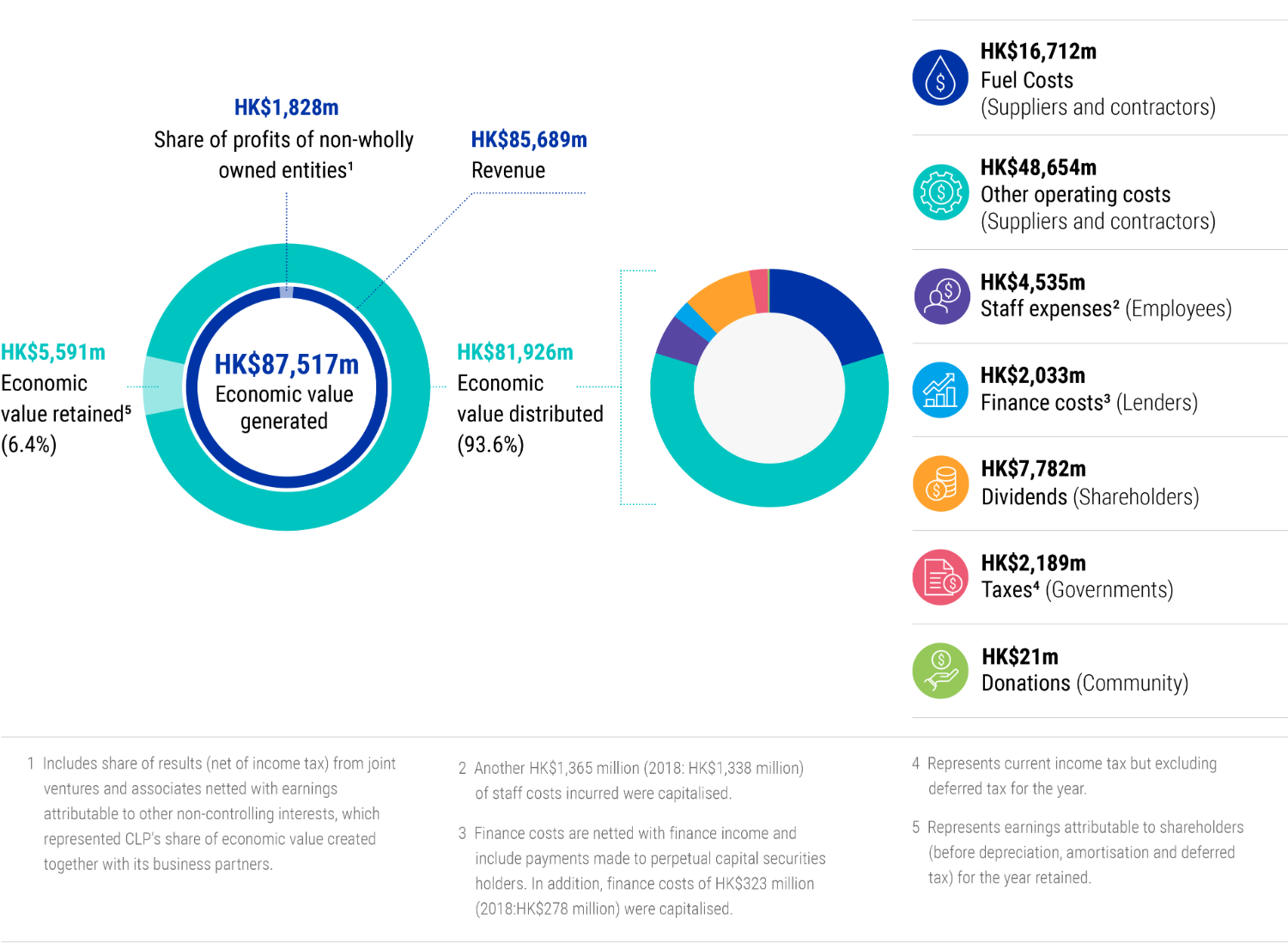

CLP emphasises value creation over the long term rather than the short term. The Group’s purpose is to do business in a way that also helps serve the communities in which it operates. The value created by the Group is shared amongst different stakeholders in society: in 2019, 93.6% of the economic value CLP generated was distributed to stakeholders, including employees, suppliers and contractors, lenders, shareholders, government and the community at large.

Strategy

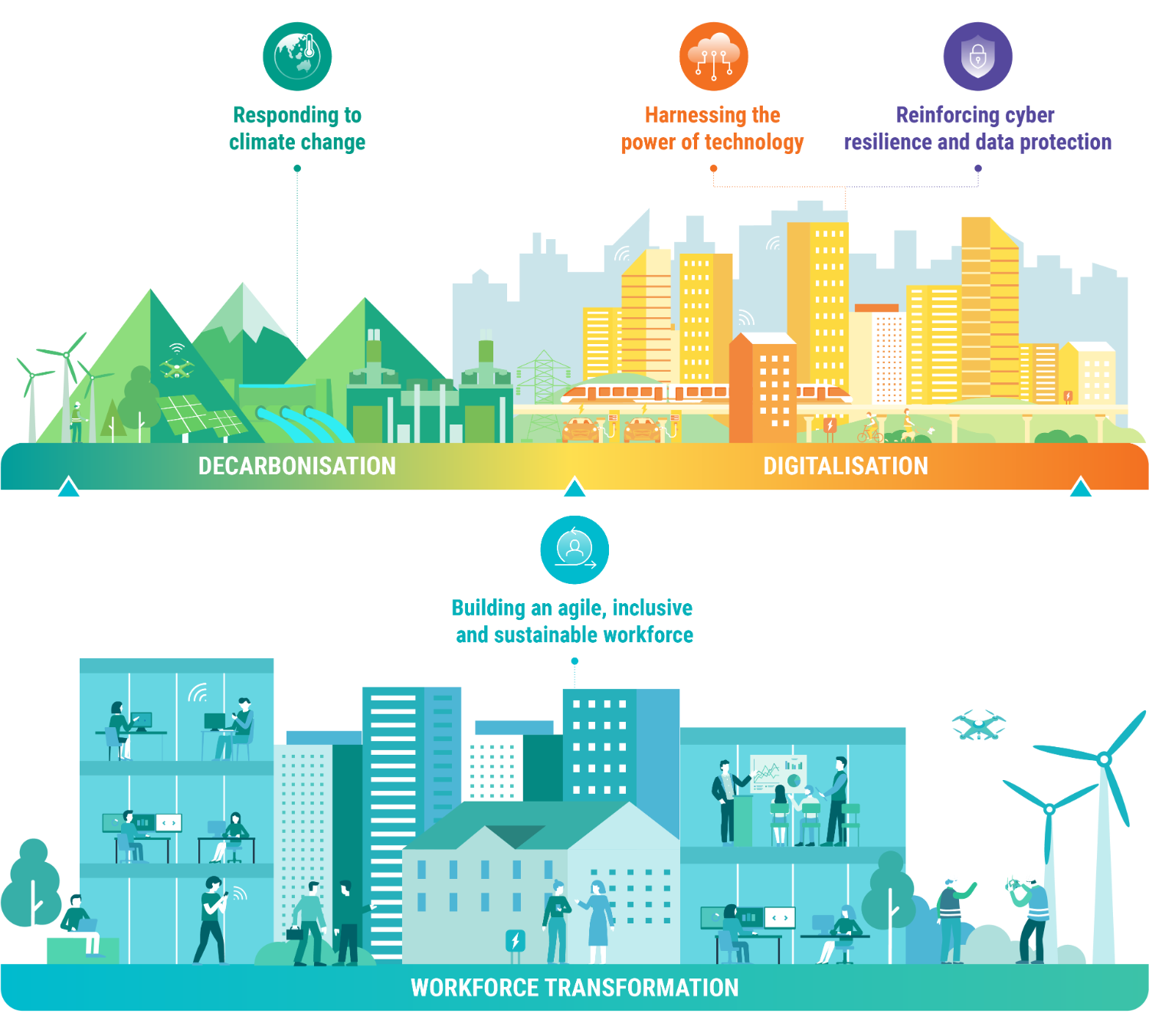

Decarbonisation and digitalisation are at the core of CLP’s business strategy, and sustainability is fully integrated into this strategy.

GRI reference: 102-47

The pace of change in the energy industry will continue to accelerate, and disruption will increasingly become the new normal. The linear, traditional electricity sector value chain which stood for decades has morphed into an interconnected, multidirectional mesh of opportunities. Incorporating digital solutions into the core of the energy business will be necessary to master this increasing complexity.

"Against the backdrop of climate change, progressively decarbonising our asset portfolios, empowering our customers in making better energy choices, enhancing performance of our operations, and evolving and growing our business along with the energy transition are fundamental for CLP’s strategy."

The Group is committed to a gradual retirement of its coal assets by 2050, and will no longer invest in new coal generation assets. This evolution creates the need to replace the revenue from coal-based generation over time. To this end, CLP is actively pursuing opportunities in clean energy, transmission and distribution, as well as in new energy services.

As part of the transition to a Utility of the Future, CLP has placed sustainability at the centre of its operations, ranging from decarbonisation, adoption of digital technology to talent attraction. As such, CLP does not have a stand-alone sustainability strategy but rather a business strategy to which sustainability is intrinsic.

The table below summarises the topics that are most material to CLP and the reasons why.

Read about other megatrends that are changing CLP's operating environment It is clear from generations of experience that it takes time and effort to build and maintain the trusting relationships corporates have with their communities. Across CLP’s entire business, the Company seeks to make a contribution to society by leveraging the trust that has been built, and support and collaborate with like-minded organisations to find solutions to mutual challenges together.

Business Model

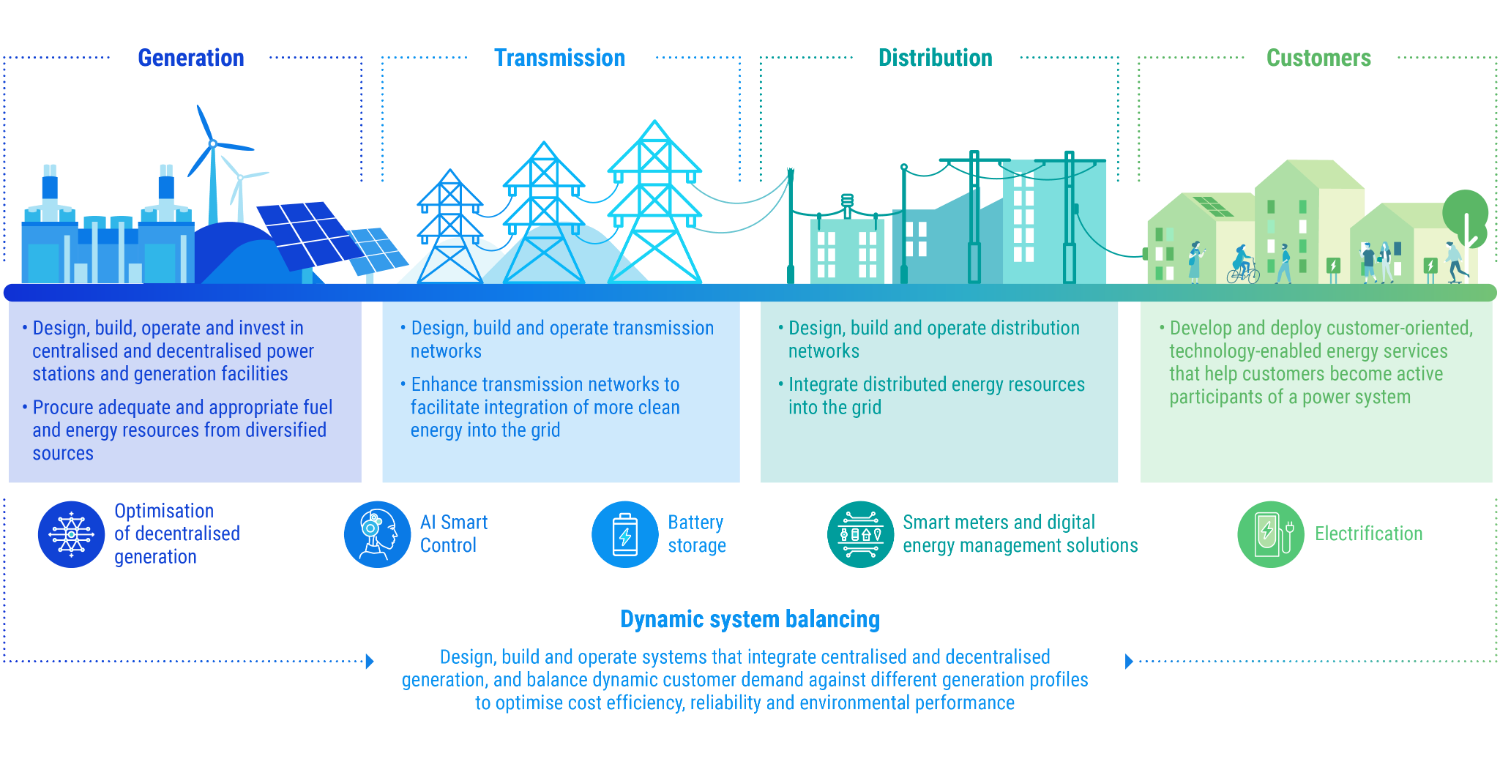

As a Group, CLP’s main focus is on electricity services and its products span the entire value chain from power generation to transmission and local distribution, to gas and electricity retail services supported by smart energy services.

CLP Holdings Limited is headquartered in Hong Kong, where it is listed on the Hong Kong Stock Exchange. Hong Kong is where the largest business operates under the brand of “CLP Power Hong Kong”. There are additional business units in Mainland China, India (under the brand of “CLP India”), Southeast Asia, Taiwan and Australia (under the brand of “EnergyAustralia”).

In these diverse markets Group companies play different roles across the electricity value chain, depending on local circumstances and market characteristics. Much of the business outside Hong Kong lies in the production of electricity, and all of the business units own sizable generation assets. CLP’s generation fleet has a balanced portfolio consisting of coal, gas, nuclear, wind, hydro and solar power facilities. The Group also operates flexible generation assets to manage intermittent and peak demand as well as storage solutions.

In 2019, CLP India entered into the power transmission sector. Through acquisition, 240 km of transmission line has been handed over to CLP India’s portfolio in 2019 and the remaining 575 km will be handed over in 2020..

Through the retail businesses in Hong Kong and Australia, CLP serves both commercial and residential customers. Wholesale customers include grid companies in Mainland China and electricity distribution companies and intermediaries in India, which purchase power directly from generating assets.

Electrification and digitisation are changing the electric utilities industry. To capture the opportunities they present, the Group is also deploying various energy services such as battery storage, smart meters and other digital energy management solutions that enable system balancing and the deployment of additional renewable resources.

Portfolio

As of 31 December 2019, the CLP Group companies had 7,960 full-time and part-time employees and a market capitalisation of HK$207 billion. The revenue in 2019 amounted to HK$85,689 million.

CLP’s business comprises over 16,000 kilometres of transmission and distribution lines, energy retail activities that serve about 5.15 million electricity and gas customer accounts, and a diversified portfolio of generation assets across five Asia-Pacific markets, using coal, gas, nuclear, wind, hydro and solar. In addition to generation facilities where CLP holds equity interests, the portfolio includes long-term capacity and energy purchase arrangements.

The equity generation capacity in operation and under construction across the Asia-Pacific region stood at 19,238MW as at the end of 2019, which was supplemented by an additional 4,777MW of long-term purchases.

The Group’s total electricity sent-out on an equity plus long-term capacity and energy purchase basis decreased to 88,573GWh in 2019 (from 92,333GWh in 2018). The total generation capacity increased from 19,108 MW in 2018 to 19,238 MW in 2019 on an equity basis – and 23,705MW to 24,015MW on an equity plus long-term capacity and energy purchase basis.

Portfolio changes

Under the Climate Vision 2050, CLP is committed to growing its investment in non-carbon emitting energy projects across the Group. In 2019, the Group continued to make significant progress: Generation from non-carbon energy sources contributed 24% of operating earnings (before unallocated expenses), amounting to HK$2,948 million, while capital investments (on accrual basis)1 in non-carbon energy sources was 8% of total capital investment or HK$967 million.

In addition, non-generation related activity from transmission, distribution, retail and Others delivered 44% of operating earnings, or $5,482 million, while capital investment in these asset types amounted to HK$5,498, representing 46% of total capital investment.

Below are the main changes in the portfolio this year:

upgrade of gas turbines in Hong Kong Black Point Power Station (25MW addition )

upgrade of gas turbine in Hallett Power Station, Australia (30MW addition)

Coleambally Solar Farm (105MW) and Bodangora Wind Farm (67.8MW) in Australia commenced operations in January and April respectively

acquisition of remaining equity of Veltoor and Gale wind farms (45.9 equity MW) and commissioning of a new solar farm in China (36.13 equity MW)

acqusition of 815 km of transmission assets in Inda, of which 240km of trasmission line has been handed over to CLP India's portfolio in 2019, and the remaining 575 km will be handed over in 2020; CLP India has also successfully bid for a 250MW wind project at Sidhpur

Find out more about CLP's assets and services View the list of CLP's assets in the Annual Report

Find out more about CLP's assets and services View the list of CLP's assets in the Annual Report