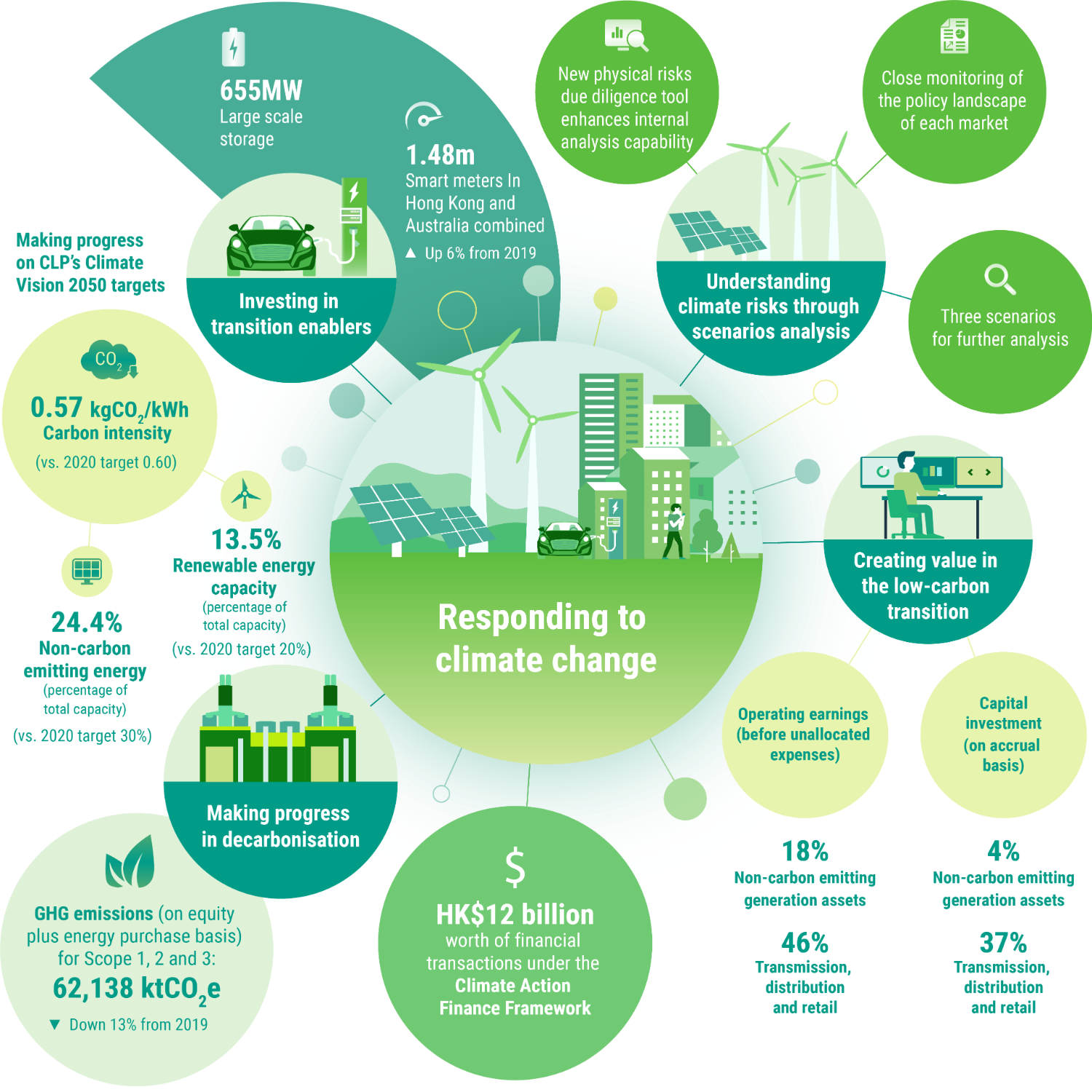

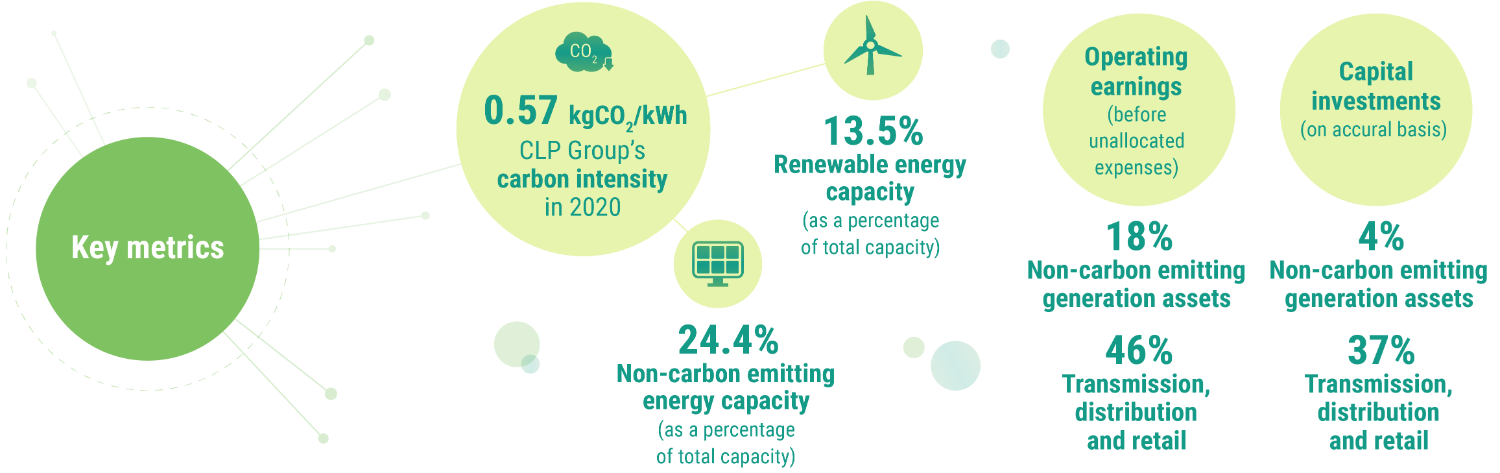

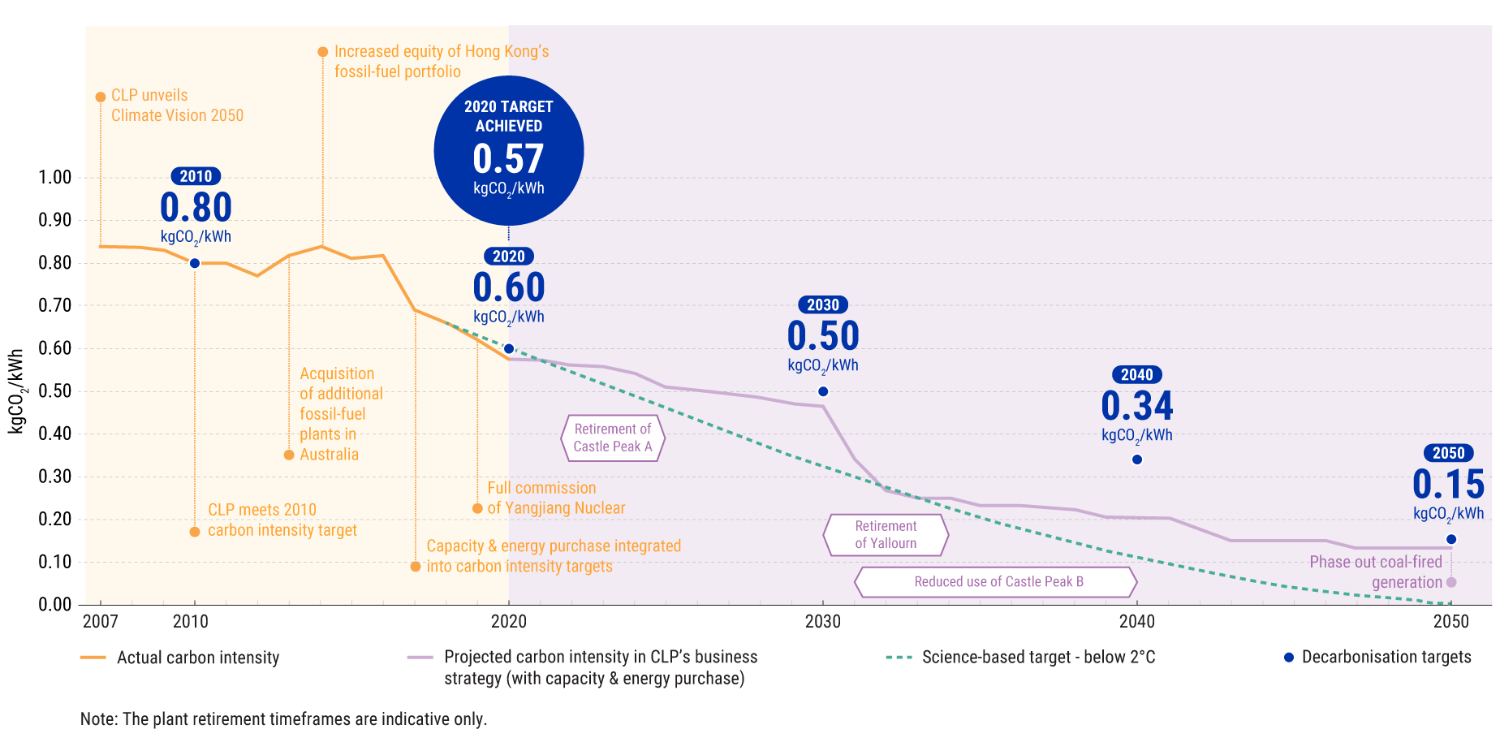

If the world continues on the current business-as-usual trajectory of GHG emissions, transition will occur only to the extent defined by currently implemented government policies, as well as policy announcements and targets which are likely to arise. Transition risks and opportunities are not significant under such a scenario.

However, a deeper and faster transition requires significant development in government policies and regulation, technology and the renewable and low-carbon market.

For CLP, three transitional trends have been identified to be most significant. They pose risks to the current business model as they erode the Company's existing value proposition. However, they present opportunities if the Company responds accordingly.

1. Increased electrification of energy consumption

Technology developments in electric vehicles (EV) and heat pumps will drive down costs and increase their competitiveness against incumbent, fossil fuel-based technologies. Overall demand for electricity will increase. In tandem, the market for providing energy services to the building sectors is also expected to grow.

The electrification of energy consumption could lead to increased corporate customer demand for renewable power purchase agreements from CLP. It could present opportunities to diversify from the current centralised generation business model towards an asset-light business model, for example, by providing EV charging infrastructure, energy services, and demand-side management and demand response.

Find out how CLP harnesses the power of technology to capture these opportunities 2. Disruption from new market entrants

Technology improvements and government policies will increase the attractiveness of low-carbon electricity generation business models including both large-scale renewables and battery storage, as well as distributed assets such as rooftop solar and virtual power plants.

There is also potential for increased competition in the energy services market due to technology improvements and the emergence of new business models, in particular in the digital space. New market entrants could be from non-traditional electric utility companies, causing disruption to current markets and increasing competition.

A possible outcome for CLP is a smaller market share in electricity generation due to competition from disruptive new market entrants. This is most likely to be material in China, India and Australia where the electricity market is open. Increased competition may also reduce the tariff received from renewable energy in the competitive renewable auctions held in these markets.

3. Implementation of low-carbon policies on the power sector

Regulatory intervention could take a number of forms. New low-carbon policies could have significant financial impacts on high-emitting assets, especially if they are enforced suddenly and without warning. On the other hand, policies could also subsidise low-carbon generation assets.

The risks to CLP arise if these interventions are not anticipated and effectively managed in asset planning. These risks include regulatory pressure to phase out legacy coal and gas assets; and increasingly stringent climate policies such as emission standards or carbon pricing requiring increased capital expenditure and operational expenditure on thermal generation plants to meet regulations.

CLP is closely monitoring the policy landscape in its markets. The government policy updates listed below are expected to impact on the operating environment in the near term:

Hong Kong

In November 2020, the Hong Kong Council for Sustainable Development recommended that Hong Kong should progressively advance to net-zero carbon emissions by 2050. Following from these recommendations, the Chief Executive of Hong Kong committed the city to strive to achieve carbon neutrality before 2050 in the 2020 Policy Address.

Some of the proposed initiatives will have a direct impact on CLP’s business, these include: securing interim lower carbon options (e.g. LNG); ramping up local renewable energy production and storage; and sourcing zero-carbon energy regionally and locally including potentially green hydrogen, for example, as and when available. CLP Power will continue to use its expertise to work with the Government and community in delivering a stable and reliable electricity supply solution for the city. Read CLP Power’s response here.

Mainland China

During the UN General Assembly in September 2020, China’s President Xi Jinping announced that China will aim to peak carbon emissions before 2030 and reach carbon neutrality before 2060. To this end, China will accelerate electrification, enlarge the scale of renewable energy, implement major enhancement on abatement technologies, and establish a well-functioning national carbon market.

Since the announcement, there has been further development on the national carbon market. The Ministry of Ecology and Environment (MEE) released the final national carbon market regulatory framework effective in February 2021, marking the operational launch of the nationwide emission trading system (ETS). The latest allocation plan (power generation sector) adopts benchmarking as the main allocation approach and includes processes for pre-allocation and ex-post adjustments. The scope of the scheme will cover 2,225 asset types including coal and gas plants.

The Government is in the process of developing a 2030 carbon emissions peaking plan, where the national ETS is expected to be one of the key policy instruments to realize the country’s climate ambition.

India

India submitted its Nationally Determined Contribution (NDC) in 2015 for implementation of the Paris Agreement in the post-2020 period. The NDC has eight goals including three quantitative targets:

Reduce emissions intensity of Gross Domestic Product (GDP) by 33% to 35% by 2030 from 2005 levels;

Achieve about 40% cumulative electric power installed capacity from non-fossil fuel based energy resources by 2030; and

Create an additional carbon sink of 2.5 to 3 billion tonnes of CO2e through additional forest and tree cover by 2030.

In 2020, the Government of India established a new taskforce to coordinate different policies required for its emissions target under the Paris Agreement, as well as international and domestic carbon market activities. Renewable energy continues to be the dominant form of energy added to India's electricity system and policy initiatives are moving to address issues of storage and firming capacity as penetration of renewables continue to rise. The Government is planning to issue guidelines for domestic and international rules for carbon pricing, market mechanisms, and other instruments. Establishment of domestic emissions trading schemes for both particulates pollution and GHG emissions are also being studied. These initiatives are expected to facilitate the launch of a domestic carbon market in India, which would be on a voluntary basis in the initial stage.

Australia

The Federal Government has confirmed that its 2030 target under the Paris Accord will remain at the 26% to 28% emissions reduction target already promised on 2005 levels and has not set a firm date for carbon neutrality. The State Governments have moved ahead with ambitious policies and support for decarbonisation. All States have separately confirmed targets for reaching carbon neutrality by 2050.

Of note, the State of New South Wales recently announced its Electricity Infrastructure Investment Roadmap to drive investment in up to 12GW of renewable energy and 2GW of long-duration energy storage over the next decade. The plan will accelerate the design and formation of large-scale renewable energy zones.

In Victoria, the Government is advancing complementary policies targeting emission reductions across sectors to meet its 2025 and 2030 targets. The Victorian Government is planning further support for new renewable energy assets, has committed to support the construction of a major utility-scale battery in Moorabool, and has announced mechanisms to drive electricity usage reduction through energy efficiency.