Climate action finance Copy linkCopied link

Strategies and procedures

The Climate Action Finance Framework (CAFF) supports the Company’s transition to a low-carbon economy by attracting socially responsible, sustainable financing. It supports CLP’s investments in reducing carbon emissions and increasing energy efficiency. Established in 2017 and updated in June 2020, the CAFF sets out how CLP proposes to raise climate action finance to invest in projects consistent with both the Group’s investment and climate strategies. The climate action finance, referred to as CLP Climate Action Finance Transactions, includes bonds, loans and other forms of finance.

CLP Group’s majority-owned business units may enter into the two types of CLP Climate Action Finance Transactions under the CAFF:

New Energy Finance Transactions – the proceeds of which help develop projects in renewable energy, energy efficiency and low emissions transportation infrastructure.

Energy Transition Finance Transactions – the proceeds of which help: (1) develop gas-fired power plants and associated enabling infrastructure to support the transition from coal-fired generation in markets with limited renewable energy resources, and (2) the conversion of coal-fired power plants and the facilities or modifications associated with such conversion, which, in both cases, will achieve carbon emission of no more than 450gCO2/kWh at baseload.

New Energy Finance Transactions are aligned with the Green Bond Principles produced by the International Capital Markets Association and the Green Loan Principles produced by the Loan Market Association. Both provide guidance in four key areas: the use of proceeds, the process for project evaluation and selection, the management of proceeds as well as reporting. Energy Transition Finance Transactions are aligned with the governance components of the Green Bond Principles and Green Loan Principles, including the process for project evaluation and selection, and the management of proceeds and reporting.

Download CLP's Climate Action Finance Framework (CAFF)

The diargram below outlines the Framework's process.

Climate Action Finance Framework

Operational responsibilities

All eligible projects of the CAFF undergo a rigorous review and approval process within a transparent framework and clear guidelines. CLP has established a Climate Action Finance Committee with the responsibility for governing the CAFF. The Committee is responsible for approving CLP Climate Action Finance Transactions and determining the eligibility of the proposed use of proceeds. Committee membership consists of the CLP Executive Director & Chief Financial Officer, as well as the CLP Chief Administrative Officer, Senior Director – Group Treasury & Project Finance and Director – Group Sustainability.

Monitoring and follow-up

All proceeds from CLP Climate Action Finance Transactions must deliver clear environmental benefits through investment in qualified projects identified by a transparent screening process. Controls are also in place to ensure that bond proceeds are only used for designated green projects. CLP produces a Climate Action Finance Report annually to track the appropriate use of proceeds and provide insight into their estimated environmental impact. The content of the report is independently assured by an auditor.

View the second party opinion on CLP Climate Action Finance Transactions Find out more about CLP’s offerings in 2020 Greenhouse gas emissions Copy linkCopied link

CLP’s commitments, climate actions and performance in decarbonisation are detailed in the Responding to Climate Change section of this report. This section focuses on how the Company compiles its GHG profile.

Greenhouse gas reporting guidelines

A Group-wide GHG reporting guideline was first developed in 2007 to specify the collection and compilation methodology of the Group’s GHG data. The guideline was developed with reference to the following international standards and guidelines:

The Greenhouse Gas Protocol: A Corporate Accounting and Reporting Standard (Revised Edition) of the World Business Council for Sustainable Development (WBCSD) and the World Resources Institute (WRI)

The Greenhouse Gas Protocol: Corporate Value Chain (Scope 3) Accounting and Reporting Standard

The Greenhouse Gas Protocol: Technical Guidance for Calculating Scope 3 Emissions (Version 1)

The 2006 Intergovernmental Panel on Climate Change (IPCC) Guidelines for National Greenhouse Gas Inventories

The IPCC 5th Assessment Report 2014

The International Standard for GHG Emissions ISO 14064-1: Greenhouse Gases

Methodologies agreed with local authorities.

The internal GHG emission reporting guideline is reviewed in accordance with CLP practice and updated with latest references at least once every three years. The current guideline was last updated in 2019.

CLP’s GHG emissions inventory covers six GHGs specified in the Kyoto Protocol, including carbon-dioxide (CO2), methane (CH4), nitrous oxide (N2O), hydrofluorocarbons (HFCs), and sulphur hexafluoride (SF6). Perfluorocarbons (PFCs) are also included but not used in CLP’s operations. Nitrogen trifluoride (NF3), the seventh mandatory gas added under the second Kyoto Protocol, was also considered for inclusion, but after evaluation was deemed immaterial to CLP’s operations. The GHG reporting scope definitions for GHG emissions are available here.

Compilation bases

CLP reports the GHG emissions of its generation and energy storage portfolio on three consolidation bases to provide a comprehensive overview of its carbon footprint and progress in decarbonisation efforts. The three bases are:

Equity basis: This includes the electricity generated by CLP’s assets. It accounts for the Scope 1 and Scope 2 GHG emissions according to CLP’s equity share in the portfolio. The equity basis reflects economic interest, indicating the extent of GHG risks and opportunities CLP has from its assets with majority and minority share.

Equity and long-term capacity and energy purchases: This includes both electricity generated by CLP’s assets as well as the electricity purchased through capacity and energy purchase agreements. It allows stakeholders to better understand the carbon intensity of the electricity CLP delivers to customers. In addition to the GHG emissions from the equity basis, it also includes the direct GHG emissions from the generation of purchased electricity.

Purchase agreements help the Group meet local market needs and usually entail significant investment. To qualify for inclusion in this metric, these long-term capacity and energy purchase agreements must have a duration of at least five years and the equivalent capacity of 10MW or more.

Operational control: This represents the total GHG emissions from generation assets where CLP has direct influence and control on operational matters. CLP has been disclosing the combined total Scope 1 and Scope 2 GHG emissions on this basis for over a decade, and will continue to demonstrate its long-term progress.

Conscious of emissions along the value chain, in 2019, the Company conducted a review of its Scope 3 emissions and started to disclose Scope 3 emissions to present a more comprehensive picture of its footprint along the value chain. Scope 3 emissions typically represent less than 40% of the CLP’s GHG emissions.

Calculation methodologies

Scope 1 & Scope 2 GHG emissions

The emissions are calculated in accordance to CLP’s internal GHG reporting procedures outlined above.

Annually, CLP obtains emission factors from each business unit’s local government and authorities in their respective jurisdictions. In cases where local emission factors are not available, other recognised sources are referenced.

Scope 3 GHG emissions

The table below summaries the Scope 3 categories that were identified as relevant to CLP, and how their emissions are calculated.

Scope 3 GHG emissions categories relevant to CLP

Scope 3 category | Relevance to CLP | Calculation and emission factors |

|---|---|---|

1: Purchased goods and services Emissions from the extraction, production and transportation of goods and services purchased or acquired. |

|

|

|

| |

2: Capital goods Emissions from the extraction, production and transportation of capital goods purchased or acquired. |

|

|

3: Fuel- and energy- related activities Emissions related to the extraction, production and transportation of fuels and energy purchased or acquired. |

|

|

|

| |

5: Waste generated in operations Emissions from the disposal and treatment of waste generated. |

|

|

6: Business travel Emissions from the transportation of employees for business-related activities. |

|

|

7: Employee commuting Emissions from the transportation of employees between their homes and their worksites. |

|

|

11: Use of sold products Emissions from the end-use of products sold. |

|

|

The following categories were identified as non-relevant to CLP, and hence not included in the Scope 3 emissions profile for reporting.

Scope 3 categories that are not considered relevant to CLP

Scope 3 category | Explanation |

|---|---|

4: Upstream transportation and distribution Emissions from transportation and distribution of purchased goods and services. | The emissions are covered in Category 1 as the financial spend on transportation and distribution is embedded in the financial spend on purchased goods and services. |

8: Upstream leased assets Operation of assets leased by the reporting company, i.e. lessee. | CLP does not operate leased generation assets. The emissions of leased offices are included in CLP’s Scope 2 emissions. |

9: Downstream transportation and distribution Emissions from the transportation and distribution of products sold between operations and the end consumer, in vehicles and facilities not owned or controlled or paid for by the reporting company. | Electricity and gas are the main products of CLP. Transportation and distribution of the products do not involve vehicles and facilities not owned or controlled by the Group. |

10: Processing of sold products Processing of intermediate products sold by downstream companies, e.g. manufacturers. | With electricity and gas being CLP's main products, they are end products without further processing requirement. |

12: End-of-life treatment of sold products Waste disposal and treatment of products sold at the end of their life. | With electricity and gas being CLP's main products, there is no end-of-life treatment requirement. |

13: Downstream leased assets Operation of assets owned by the reporting company (lessor) and leased to other entities. | Leasing is not a main business for CLP. |

14: Franchises Operation of franchises. | CLP does not have any franchising business. |

15. Investments Emissions from operation of investments. | CLP reports Scope 3 emissions on an equity basis. This category applies to CLP only when an operational control basis is adopted and is therefore not applied. |

Renewable Energy Certificates in Hong Kong Copy linkCopied link

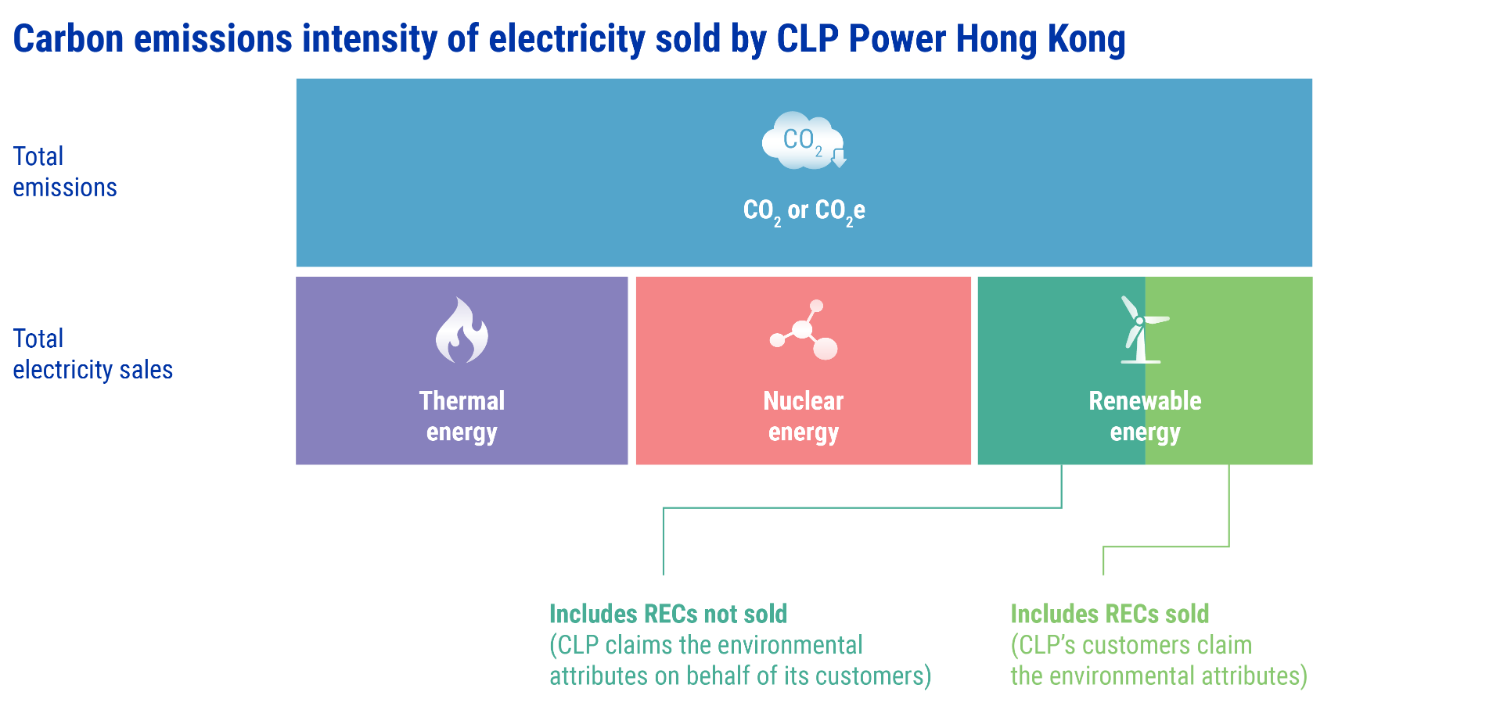

The carbon emissions intensity of all electricity sold by CLP Power Hong Kong is measured in CO2/kWh and CO2e/kWh. The intensity is calculated by dividing the total carbon emissions from local generation assets owned or controlled by CLP Power/CAPCO in Hong Kong by the total electricity sales of CLP Power Hong Kong. Emissions from the Guangdong Daya Bay Nuclear Power Station are insignificant; total electricity sales include thermal power generation, nuclear power generation, and renewable energy generation that is connected to the CLP grid regardless of whether it is sold in the form of RECs.

CLP Power provides its carbon intensity for its customers in Hong Kong to calculate their Scope 2 emissions. It is the carbon emissions intensity of total electricity sales which excludes RECs sold, and can be found in CLP Power's website. REC holders can claim that they reduce a certain amount of carbon emissions for each unit of electricity carried in the REC, through which they have purchased the “environmental attributes” of electricity generated from renewable energy sources. “Environmental attributes” refers to the right to claim all greenhouse gas and other pollutant emission reduction benefits associated with the renewable electricity generated. To calculate their Scope 2 emissions, REC holders can multiply that specific intensity with their electricity consumption, excluding the volume of RECs purchased.

This is explained in the schematic diagram below.

Greenhouse gas emissions

Greenhouse gas emissions | 2020 | 2019 | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|

CLP Group1 | |||||

Total CO2e emissions – on an equity basis (kt)2,3 | 62,138 | 71,720 | N/A | N/A | N/A |

CO2e - Scope 1 (kt)4 | 45,105 | 50,047 | N/A | N/A | N/A |

CO2e - Scope 2 (kt) | 244 | 250 | N/A | N/A | N/A |

CO2e - Scope 3 (kt) | 16,790 | 21,424 | N/A | N/A | N/A |

Category 1: Purchased goods and services | 1,210 | 1,093 | N/A | N/A | N/A |

Category 2: Capital goods | 685 | 1,347 | N/A | N/A | N/A |

Category 3: Fuel- and energy-related activities | 12,690 | 16,671 | N/A | N/A | N/A |

Category 5: Waste generated in operations | 63 | 101 | N/A | N/A | N/A |

Category 6: Business travel | 1 | 8 | N/A | N/A | N/A |

Category 7: Employee commuting | 2 | 4 | N/A | N/A | N/A |

Category 11: Use of sold products | 2,138 | 2,200 | N/A | N/A | N/A |

CLP Group's generation and energy storage portfolio3,4,5,6 | |||||

CO2 – on an equity basis (kt) | 44,987 | N/A | N/A | N/A | N/A |

CO2 – on an equity plus long-term capacity and energy purchase basis (kt)7 | 48,621 | N/A | N/A | N/A | N/A |

CO2 – on an operational control basis (kt) | 43,808 | 50,412 | 52,052 | 47,921 | 46,518 |

CO2e – on an operational control basis (kt) | 44,023 | 50,676 | 52,306 | 48,082 | 46,681 |

- Refers to a range of businesses, including generation and energy storage portfolio, transmission and distribution, retail and others.

- Numbers have been subject to rounding. Any discrepancies between the total shown and the sum of the amounts listed are due to rounding.

- Paguthan Power Station, the power purchase agreements of which expired in December 2018, was not included in the 2019 and 2020 numbers.

- In accordance with the Greenhouse Gas Protocol, WE Station, which makes use of landfill gas from waste for power generation, is not included in CLP’s Scope 1 CO2 emissions and reported separately in the Asset Performance Statistics. Its non-CO2 GHG emissions (i.e. CH4 and N2O) is included in CLP’s Scope 1 CO2e emissions

- Starting from 2020, the portfolio includes energy storage assets and generation assets. Energy storage assets include pumped storage and battery storage. In previous years, the portfolio included generation assets only.

- CO₂ emissions of Yallourn and Hallet Power Stations have been used since 2018. Prior to 2018, CO₂e emissions data of these assets were used.

- Numbers include assets with majority and minority share, and those under "long-term capacity and energy purchase" arrangements with CLP. Starting from 2018, "long-term capacity and energy purchase" has been defined as a purchase agreement with duration of at least five years, and capacity or energy purchased being no less than 10MW.

Climate Vision 2050 | 2020 | 2019 | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|

Performance against targets - on an equity basis1,2,3,4 | |||||

Carbon dioxide emissions intensity of CLP Group’s generation and energy storage portfolio (kg CO2/ kWh) | 0.65 | 0.70 | 0.74 | 0.80 | 0.82 |

Renewable energy generation capacity (% (MW)) | 12.8 (2,517) | 12.8 (2,469) | 12.5 (2,387) | 14.2 (2,751) | 16.6 (3,090) |

Non-carbon emitting generation capacity (% (MW)) | 20.9 (4,110) | 21.1 (4,069) | 20.9 (3,987) | 22.4 (4,350) | 19.2 (3,582) |

Performance against targets - on an equity plus long-term capacity and energy purchase basis1,2,3,4,5 | |||||

Carbon dioxide emissions intensity of CLP Group’s generation and energy storage portfolio (kg CO2/ kWh) | 0.57 | 0.62 | 0.66 | 0.69 | 0.72 |

Renewable energy generation capacity (% (MW)) | 13.5 (3,342) | 13.7 (3,294) | 12.8 (3,039) | 13.1 (3,211) | 14.9 (3,551) |

Non-carbon emitting generation capacity (% (MW)) | 24.4 (6,017) | 24.9 (5,979) | 24.1 (5,724) | 23.2 (5,699) | 20.7 (4,931) |

- Starting from 2020, the portfolio includes energy storage assets and generation assets. Energy storage assets include pumped storage and battery storage. In previous years, the portfolio included generation assets only.

- Paguthan Power Station, the power purchase agreements of which expired in December 2018, was not included in the 2019 and 2020 numbers.

- In accordance with the Greenhouse Gas Protocol, WE Station, which makes use of landfill gas from waste for power generation, is not included in CLP’s Scope 1 CO2 emissions and reported separately in the Asset Performance Statistics. Its non-CO2 GHG emissions (i.e. CH4 and N2O) is included in CLP’s Scope 1 CO2e emissions.

- CO₂ emissions of Yallourn and Hallet Power Stations have been used in 2018. Prior to 2018, CO₂e emissions data of these assets were used.

- Numbers include assets with majority and minority share, and those under "long-term capacity and energy purchase" arrangements with CLP. Starting from 2018, "long-term capacity and energy purchase" has been defined as a purchase agreement with duration of at least five years, and capacity or energy purchased being no less than 10MW.

CLP Power Hong Kong - carbon emissions intensity of electricity sold | 2020 | 2019 | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|

CO2e emissions intensity of electricity sold by CLP Power Hong Kong (kg CO2e/ kWh)1,2 | 0.37 | 0.50 | 0.51 | 0.51 | 0.54 |

CO2 emissions intensity of electricity sold by CLP Power Hong Kong (kg CO2/ kWh)1,2 | 0.37 | 0.49 | 0.51 | 0.50 | 0.54 |

- In accordance with the Greenhouse Gas Protocol, WE Station, which makes use of landfill gas from waste for power generation, is not included in CLP’s Scope 1 CO₂ emissions and reported separately in the Asset Performance Statistics. Its non-CO₂ GHG emissions (i.e. CH4 and N₂O) is included in CLP’s Scope 1 CO₂e emissions

- "Electricity sold" is the total electricity energy sold to CLP Power Hong Kong's customers before adjustment of Renewable Energy Certificates.

Climate-related financial information

Capital investments | 2020 | 2019 | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|

Total capital investments incurred by asset type (% (HK$M))1,2 | 100 (13,022) | 100 (12,028) | 100 (12,851) | N/A | N/A |

Transmission, distribution and retail | 37 (4,810) | 43 (5,229)3 | 39 (4,953) | N/A | N/A |

Coal | 28 (3,638) | 21 (2,473)3 | 24 (3,040) | N/A | N/A |

Gas | 26 (3,445) | 26 (3,146)3 | 32 (4,098) | N/A | N/A |

Nuclear | 0 (0) | 3 (352) | 0 (0) | N/A | N/A |

Renewables | 4 (462)4 | 5 (580)3,5 | 5 (714) | N/A | N/A |

Others | 5 (667) | 2 (248)3 | 0 (46) | N/A | N/A |

- Capital investments include additions to fixed assets, right-of-use assets and intangible assets, investments in and advances to joint ventures and associates, and acquisition of businesses.

- On an accrual basis.

- Restated to conform with enhanced 2020 allocation model and methodology.

- Includes HK$7 million from waste-to-energy, which is not considered as non-carbon emitting energy.

- Includes HK$123 million from waste-to-energy, which is not considered as non-carbon emitting energy.

Operating earnings | 2020 | 2019 | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|

Total operating earnings by asset type (% (HK$M))1 | 100 (12,374) | 100 (12,138)2 | 100 (15,145) | 100 (14,189) | 100 (13,173) |

Transmission, distribution and retail | 46 (5,751) | 42 (5,131)2 | 49 (7,427) | 59 (8,392) | 59 (7,798) |

Coal3 | 23 (2,871) | 21 (2,503)2 | 22 (3,370) | 28 (3,994) | 30 (3,905) |

Gas3 | 12 (1,510) | 14 (1,735)2 | 10 (1,533) | ||

Nuclear | 13 (1,594) | 14 (1,688) | 11 (1,720) | 7 (913) | 7 (863) |

Renewables | 5 (575)4 | 8 (1,016)2,5 | 7 (924) | 4 (629) | 3 (455) |

Others | 1 (73) | 1 (65)2 | 1 (171) | 2 (261) | 1 (152) |

- Before unallocated expenses.

- Restated to conform with enhanced 2020 allocation model and methodology.

- Starting from 2018, operating earnings of coal and gas have been reported separately.

- Includes HK$8 million from waste-to-energy, which is not considered as non-carbon emitting energy.

- Includes HK$5 million from waste-to-energy, which is not considered as non-carbon emitting energy.

2020 data shaded in orange have been independently verified by PricewaterhouseCoopers. The assurance scope of past years' data can be found in previous Sustainability Reports.